The global marketplaces industry has been steadily growing for over a decade and is projected to make up over 20% of all consumer spending by 2027, according to experts. So, if you’re thinking about building a marketplace that could become the next Amazon, now is the perfect time.

This post will tell you how to build a marketplace platform step-by-step. Our team has gained extensive knowledge from almost ten years of experience in creating marketplaces. One notable project we’ve worked on is Fuzu, a job search and HR marketplace that secured $6.6M in funding after its relaunch.

The Syndicode team has revamped the platform’s user interface and introduced innovative features that contributed to Fuzu’s growth and market expansion.

But enough about us, let’s discuss how to create a marketplace. In a nutshell, it involves eight steps:

- Determine the demand

- Define the target market

- Choose the revenue model

- Determine the business model

- Select functionality

- Assemble a team

- Plan and build the marketplace website

- Launch and maintain

We’ll also address common challenges and help you estimate the costs involved.

Let’s get started!

What is a marketplace platform?

An online marketplace is a website where multiple sellers offer their products or services to potential buyers.

To decide how to create a marketplace of the right type, let’s first see the existing classification. The main criteria for marketplace classification are based on the participants, focus, and offerings.

Let’s take a closer look at these.

Online marketplace classification by participants:

- Business-to-consumer (B2C) model describes marketplaces where companies sell to end-users. A famous example is Amazon.

- Consumer-to-business (C2B) platforms connect individual service providers with businesses. A popular example is Upwork, which links employers with individual contractors.

- Business-to-business (B2B) marketplace websites involve businesses selling their product or services to other companies. Alibaba is a prime example of a B2B marketplace.

- Customer-to-customer (C2C) marketplaces are where individual users interact with one another. If you’ve ever bought or sold items on eBay or Etsy, you’ve participated in a C2C transaction.

Online marketplace classification by focus:

- Horizontal marketplaces offer a wide range of products to a broad audience. You can find items like toys, books, clothing, and electronics on these marketplaces.

- Vertical marketplace websites offer specific products or services to a niche audience. Examples of successful vertical marketplaces include Airbnb and Udemy.

Online marketplace classification by offerings:

- Product marketplaces primarily sell physical goods that one can touch and feel, such as clothes, books, and beauty care products.

- Service marketplaces are designed to connect buyers with skillful professionals for almost any activity. Whether you need a logo designer or someone to run a Facebook Ad campaign, you can find a specialist for such tasks there.

- Project marketplaces enable entrepreneurs to raise money for their startup projects through crowdfunding. Kickstarter is a well-known example of a project marketplace.

Here’s a table summarizing the main types of online marketplaces:

| Classification | Description | Examples |

|---|---|---|

| Participants | ||

| B2C | Companies sell to individual end-users | Amazon |

| C2B | Individuals offer services to businesses | Upwork |

| B2B | Businesses sell to other companies | Alibaba |

| C2C | Transactions occur between individual users | eBay, Etsy |

| Focus | ||

| Horizontal | Offers a wide range of products to a broad audience | Amazon |

| Vertical | Specializes in specific products or services | Airbnb, Udemy |

| Offerings | ||

| Product | Primarily sells physical goods, such as clothes or books | Walmart, Rakuten |

| Service | Connects buyers with professionals for services, such as graphic design | Upwork, Fiverr, TaskRabbit |

| Project | Allows fundraising for startup projects | Kickstarter |

Benefits of creating an online marketplace

Building an online marketplace can offer various benefits that make it a sound business decision. Here are the key advantages of creating a marketplace:

- Increased revenue opportunities. By providing a platform for multiple sellers, you can earn revenue through commissions, transaction fees, or subscription models. Additionally, starting a marketplace website allows you to broaden your customer base, as the wide variety of products or services will attract a larger audience.

- Diversification of income streams. A marketplace website creates several revenue sources, providing a safety net against economic downturns or market fluctuations. The more products and services your marketplace offers, the more resilient and adaptable your business becomes. Therefore, when deciding how to build your marketplace, consider introducing value-added services, like white-label solutions, escrow services, dispute resolution, or verification services, for a fee.

- Reduced financial risks. Unlike traditional retail, an e-commerce platform doesn’t require managing an inventory. You won’t need to deal with warehousing, logistics, or delivery, as these responsibilities typically fall on the sellers.

- Exit opportunities. Building a marketplace website can be a lucrative venture. Online marketplaces are appealing to investors, providing various exit strategies. You can choose to sell your marketplace or take different paths depending on the desired level of involvement in its future.

Got a billion-dollar idea?

We can make it real. Partner with a team that has been building award-winning solutions from scratch. Check out our process and featured cases.

See servicesHow to build an online marketplace website from scratch

There is no one right way to build a marketplace, but we’ve developed a framework over the years through our experience creating and maintaining marketplace websites. This framework helps us develop products that, when managed well, have the potential to disrupt their respective industries.

One of our successful projects is EvrLearn, an educational platform designed for the Swiss market. The client had no prior experience and didn’t know how to create a marketplace they pictured. The Syndicode team assisted in defining the marketplace concept and provided end-to-end development services.

Today, the marketplace is live and thriving, offering over 3,000 courses and collaborating with top Swiss universities.

Our framework for delivering exceptional products consists of eight key steps. Let’s delve into each of them.

Step 1. Determine the demand

In the world of marketplace creation, it’s crucial to understand what customers want and what drives their choices. These preferences are shaped by various factors, such as customer needs, current market trends, and pricing.

To gain traction, you must know how to build an online marketplace that strikes the right balance in terms of cost, features, and positioning to meet customer expectations in a specific market and timeframe. Otherwise, it’s just a waste of resources.

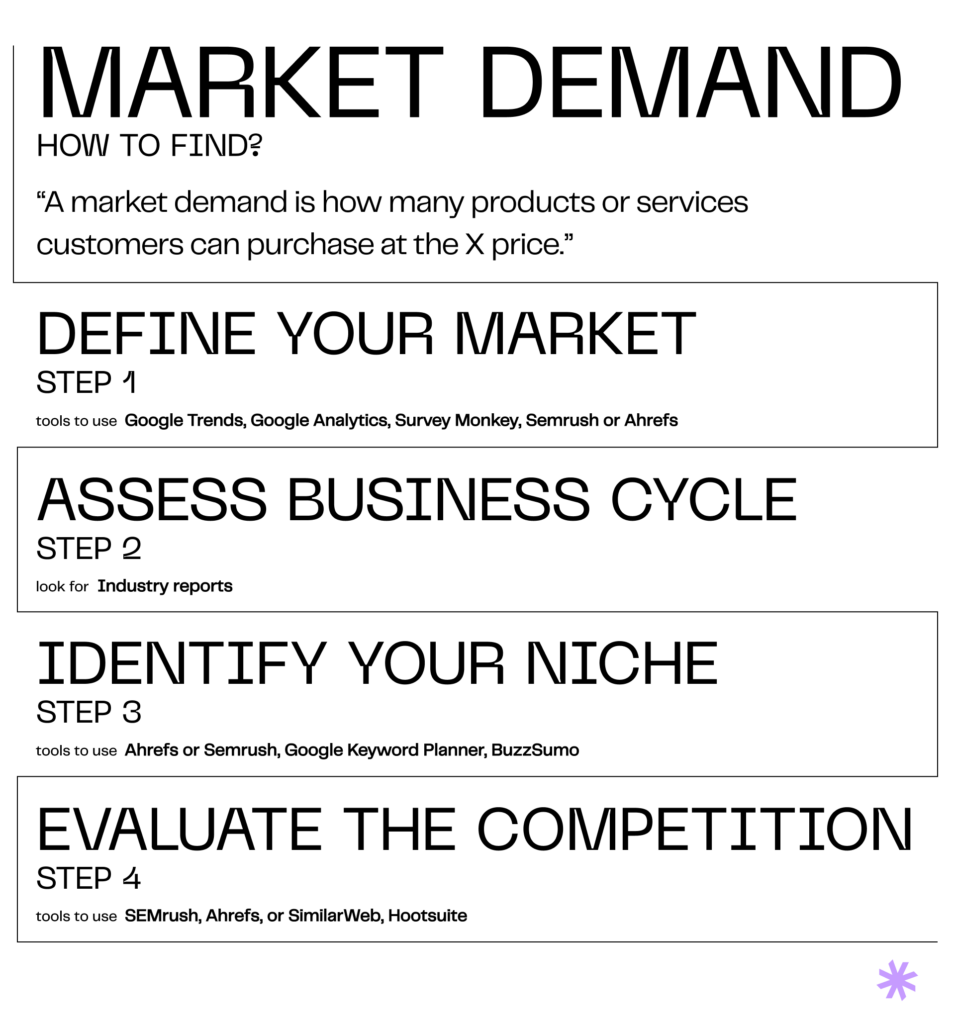

There are four steps to assess whether your marketplace is likely to be popular and, thus, worth the investment:

- Research industry trends. Start by studying industry overviews to identify the latest trends and major players. This information will provide a general idea of how to build a marketplace that offers value.

- Analyze social media. Use automated tools and manual searches to gauge public opinion about your type of marketplace and its offerings. You can also begin posting your own content and track views and responses, which will be invaluable for future marketing campaigns.

- Run a mass marketing campaign. If you don’t yet have much data, consider running an untargeted campaign. It will help you identify the types of people naturally interested in the products or services you plan to offer on your marketplace platform. You might even discover new markets you hadn’t considered before.

- Look for an unoccupied niche. There are dozens of marketplace websites on the Internet. Your goal is to find unexplored market areas, often referred to as a “blue ocean.” Alternatively, you can come up with an exclusive solution to a common problem.

Step 2. Define the target audience

The target market of an online marketplace platform consists of buyers and sellers. So, to effectively plan how to create a marketplace, you need to know how to attract both those groups. This knowledge will guide your overall business and development strategy as well as your marketing plan. Here are four ways to determine your target audience:

- Analyze competitors. To identify potential customers, study those who already use marketplaces similar to yours. Pay attention to how the competitors conduct their business, including the channels they use and whether they focus more on sellers or buyers.

- Define who your target audience isn’t. Some users may closely resemble your target demographic but not respond to your messaging. It’s important to be specific in identifying what sets them apart from your potential clients and how to avoid allocating advertising resources to this segment.

- Look at your social following. If you already have a dedicated social media page for your business, analyze who your current marketing efforts are resonating with.

- Use content analytics. Use tools like Ahrefs and Google Analytics to discover the most popular search terms on Google that lead to similar marketplaces as yours. Take note of the topics that strongly connect with your target market and examine the user demographics.

Step 3. Create a value proposition

You might be wondering how to build a marketplace like Amazon, but you certainly don’t want to create just a clone, do you? To stand out, you must offer users something exceptional. Today, customers are more demanding than ever, so it’s crucial to get extra creative in meeting their needs.

The best way to achieve this goal is by crafting a unique value proposition. To make your offerings appealing to your target audience, consider one of the following drivers:

- Price focus: think about how to make a marketplace website that provides customers with significantly better prices;

- Convenience focus: simplify the buying process, making it easier and quicker for buyers to find and purchase the products they need;

- Market access focus: offer consumers access to a wider range of suppliers or products.

Step 4. Choose the revenue model

To build a profitable marketplace website, you should plan how you’ll commercialize it. Let’s explore some of the most common marketplace revenue models.

- Commission. Under this business model, you charge a certain percentage of each transaction that takes place on your platform. TaskRabbit, for example, takes a 15% commission on the price paid for a particular task.

- Freemium. With this model, you provide basic marketplace functionality for free to users. However, advanced features come at an additional cost.

- Membership. Users pay monthly or yearly fees to get access to your e-commerce platform.

- Advertisement. You can allow third-party companies to promote their offerings on your platform for a specific fee.

- Listing fee. You can follow the lead of Etsy and Zillow and charge sellers a specific fee for posting their products on your marketplace.

Need a team to build a marketplace?

You have the idea, we have the tools and knowledge. Specify what it is exactly that you want to do, and we will assemble a perfect team for you.

Book a callStep 5. Choose the required functionality

When deciding how to create your marketplace, you should choose the functionality that aligns with the needs of your target market. However, there are some features that users generally expect to see on any online marketplace:

- Search and filter options. Users should be able to search for products or services using keywords and apply various filters like price range, location, seller ratings, and more to refine the search results.

- Product listings as well as the opportunity to create and manage listings for sellers. This feature typically includes fields for product descriptions, images, prices, and available quantities.

- User profiles for both buyers and sellers, featuring their personal information, reviews, and ratings.

- Rating and review system. Allow users to leave ratings and reviews for sellers and products to help others make informed decisions.

- Messaging and communication to enable buyers and sellers to communicate directly within the platform.

- Shopping cart to enable buyers to choose items, review their selections, and proceed to checkout when ready to make a purchase.

- Checkout and payment processing with secure payment options, including credit cards, digital wallets, and occasionally cash-on-delivery.

- Order tracking to provide buyers with order status monitoring, including shipping or delivery details, estimated arrival times, and notifications.

- Wishlists and favorites that allow users to save products for future reference.

- Return and refund policies and dispute resolution systems to protect users in case of issues.

- Customer support system to assist users with questions, issues, and disputes.

- Recommendation algorithms to recommend products or services to users based on their browsing and purchase history.

- Seller tools, including listing management, tracking sales, and analyzing performance.

Those are the fundamental features needed for a successful marketplace. But how to build a marketplace website that stands out from the many others? You need to introduce killer features that cannot be found on other websites.

Based on our experience, we recommend implementing the following advanced functionality:

- Augmented reality. This feature allows customers to visually assess products before making a purchase. For instance, the IKEA Place mobile app enables customers to place 3D models of furniture in their space to help them find the perfect fit.

- Voice search. Voice commerce is gaining popularity, with more people using voice assistants like Siri, Alexa, or Google to make purchases. Offering this option as an alternative to typing or clicking can enhance the shopping experience.

- Image search. Consider letting shoppers search for items using images. This is particularly useful when a customer doesn’t know the brand or exact model they’re looking for.

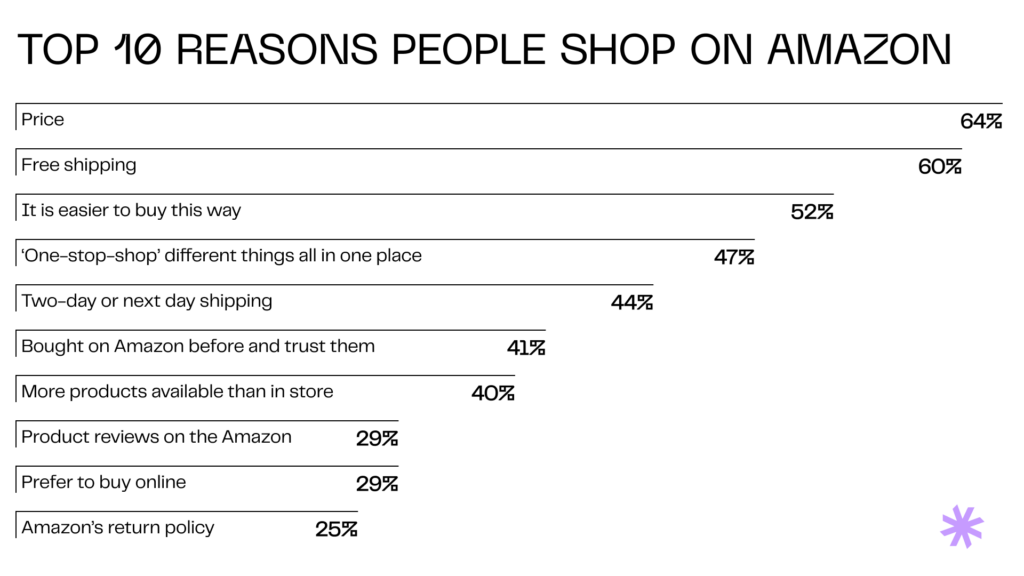

Below is a graph representing the top reasons people prefer shopping on Amazon. Make sure to take that into consideration when creating your marketplace website.

Step 6. Find a development team

Collaborating with a dependable and knowledgeable development team is crucial to bringing your idea to life smoothly and within your budget. To go about choosing a partner, you should first decide how hands-on you want to be in the marketplace app development process. There are three engagement models with varying implications for both employers and workers:

- Traditional employment involves a long-term commitment, with direct management and supervision of employees by the employer. You’ll also be responsible for tax withholding, providing benefits, and ensuring compliance with labor laws and regulations.

- Outsourcing offers greater flexibility. You can tap into external expertise for short-term or project-specific needs. You can also choose to hire individual engineers or opt for a dedicated development team.

- Staff augmentation services model combines elements of both traditional employment and outsourcing. An outstaffing provider employs the workers, but they work as part of the client company’s team.

Read also: The Guide to Staff Augmentation

When seeking a reliable marketplace development partner, it’s important to consider where to look for and what to look for. That said, the top popular places for hiring software development specialists are:

- Fiverr is ideal for short-term projects without extensive customization. The platform focuses on one-time purchases and predefined service packages known as “gigs.”

- Upwork is suitable for both short-term and ongoing projects. It houses freelancers seeking various collaboration durations.

- Clutch features software development companies. You can search for providers in specific niches, locations, and price ranges.

For more details, you can refer to our previous blog post, “Top 5 Upwork Alternatives,” where we conducted a thorough comparison of these platforms.

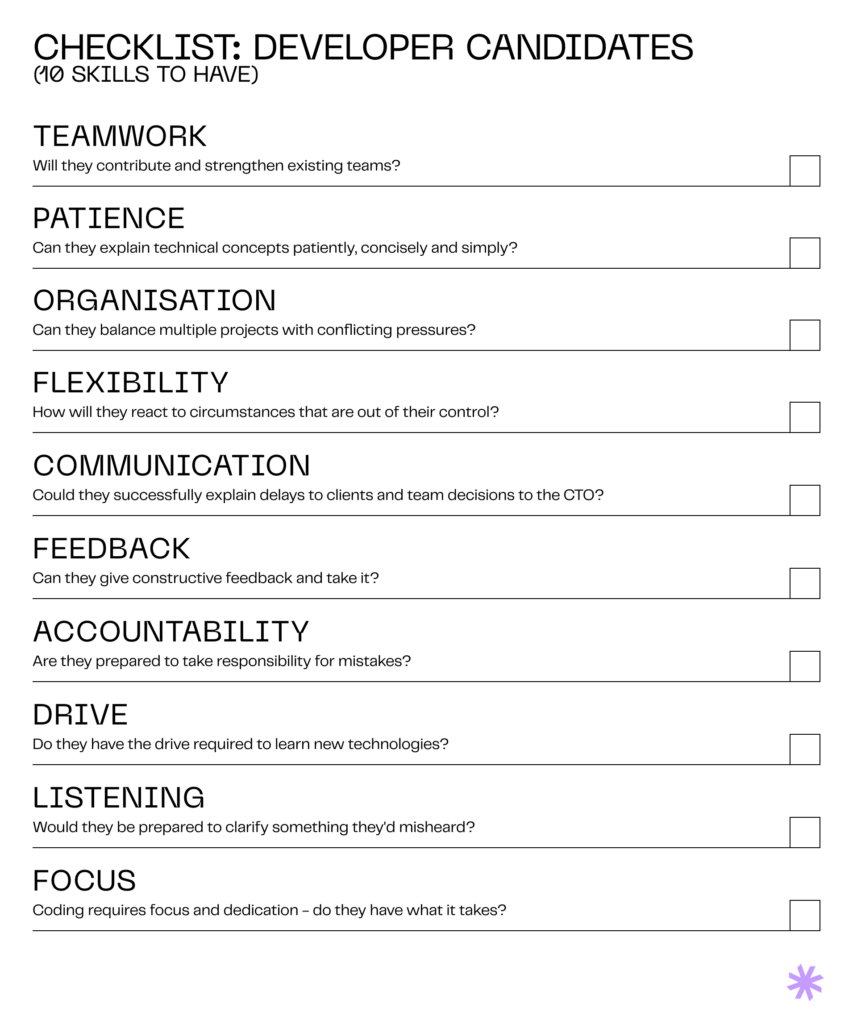

What to look for in a reliable software development partner? Here are the most crucial things to consider:

- Expertise. A reputable development partner should have a proven track record of creating and maintaining online marketplaces similar to your project.

- Communication must be clear and open. All parties should understand each other, regardless of their technical or business expertise or cultural differences.

- Quality assurance (QA) and testing processes must be robust to guarantee that the software adheres to quality and security standards.

- Innovation and problem-solving are crucial skills for a good software development partner. They should not only execute your requirements but also bring innovative ideas to the table and be skilled at solving problems that arise during the project.

Step 7. Plan and execute the development

To streamline the development process and ensure a high-quality marketplace, development teams typically follow a well-established set of steps. At Syndicode, the product development lifecycle is structured as follows:

- Discovery session

- Business analysis

- UI/UX design

- Coding

- QA and testing

We follow agile development principles, breaking the project into sprints, each with a specific goal. The team goes through the steps mentioned earlier for each sprint. This approach enables us to deliver working software quickly and remain flexible and adaptive to changes in the project’s requirements.

For more detailed information on the software development process, you can refer to our earlier blog post.

For complex marketplace development projects and startups, we strongly recommend building an MVP first. This way, you can get your solution to the market quickly and easily make adjustments if your initial strategy doesn’t yield the expected results.

Now, let’s delve into the development lifecycle with more detail:

Discovery phase

During this initial phase, our team collaborates with the client to discuss project goals and constraints and estimate the project’s scope. We gain a deep understanding of the client’s business, their target audience, select the appropriate technology stack, and create a high-level development plan along with rough cost estimates.

We have a comprehensive article explaining the goals and deliverables of the discovery phase here.

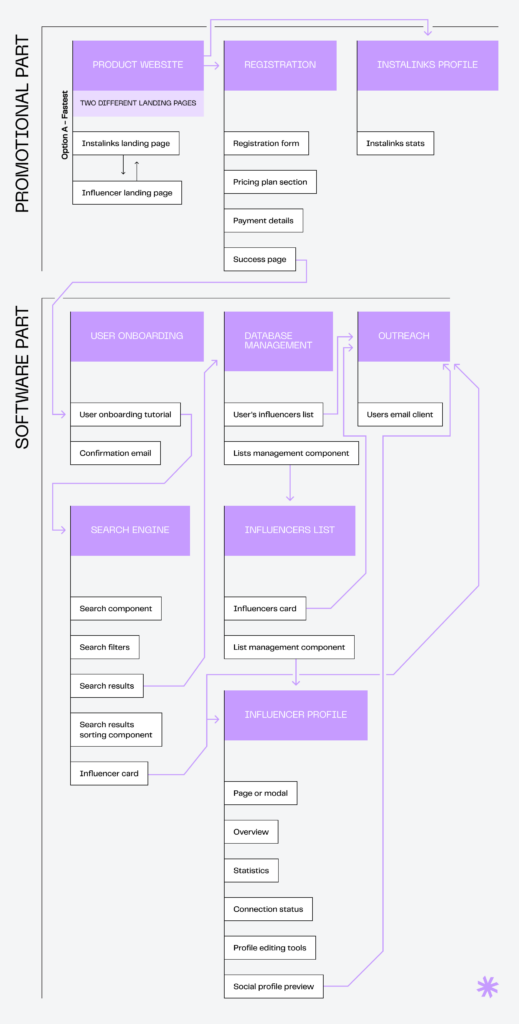

Business analysis

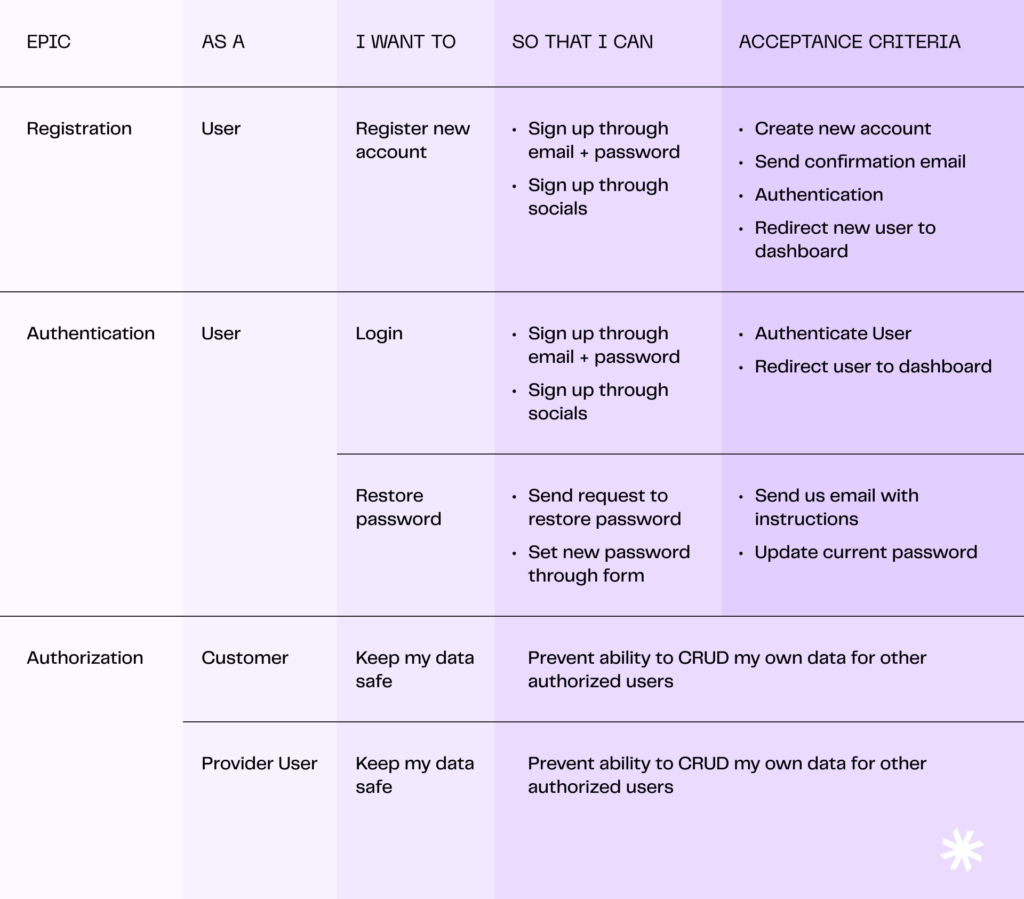

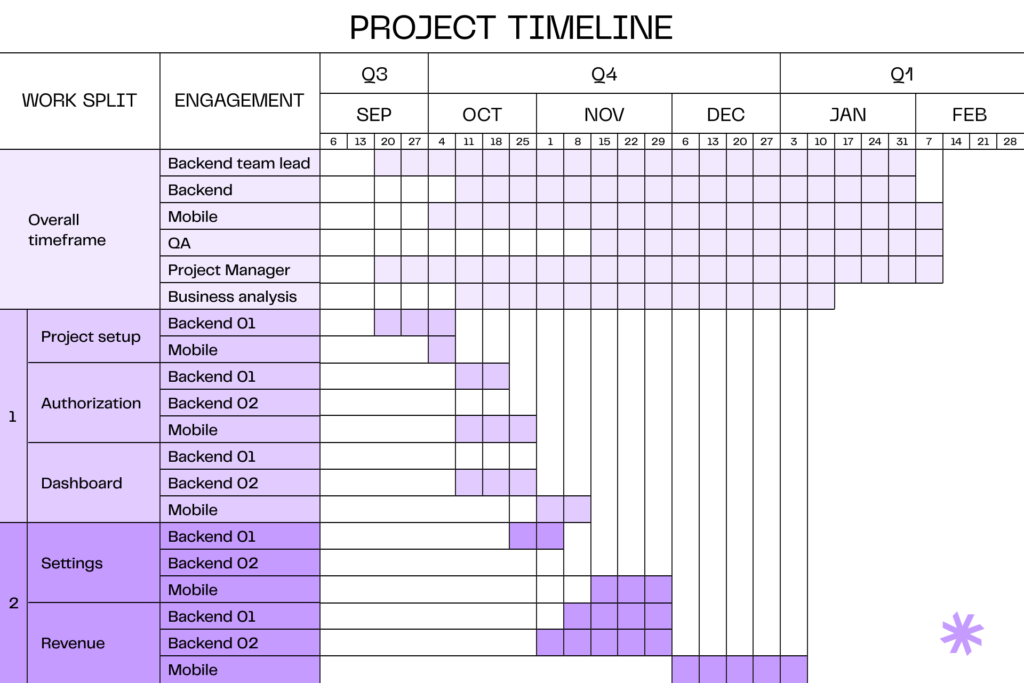

In this stage, our project team focuses on creating an architecture of the online marketplace website. We define its layout, infrastructure, user experience, and software modules. Following this, we create technical specifications based on user stories.

Next, Syndicode’s analysts create a project timeline and clarify the initial time and cost estimates.

UI/UX design

Designers begin by crafting an information architecture for the marketplace, which serves as the foundation for creating visual concepts and wireframes. Once the client approves these concepts and layouts and the engineers confirm the technical feasibility of the proposed design, the UI design phase is initiated.

This structured approach ensures that the design aligns with the project’s goals and can be successfully implemented by the development team.

Coding

During the coding phase, the engineering team translates the plans and designs into functional code. At Syndicode, we adhere to specific code attributes, including simplicity, thorough testing, refactoring, documentation, and compliance with industry standards as specified by the client.

QA and testing

At Syndicode, testing is integrated into the coding stage to accelerate development without compromising quality. When the primary components of an application are finished and integrated, the entire product undergoes comprehensive testing before release.

Our quality assurance engineers conduct manual and automated tests to ensure that the online marketplaces we create are secure, reliable, and free from bugs. They also verify that the code is well-organized and that it meets the business requirements.

Once the testing is finalized, the code is deployed to a staging server for further evaluation by a manual tester. If everything functions as expected, the code can be merged into the master branch. After that, it is tested once again in a production environment to guarantee its stability and functionality.

Read also: Why is quality assurance important?

Step 8. Launch and maintenance

Before introducing your solution to the market, it’s vital to ensure that all product features operate as intended. To ensure that the created online marketplace is secure, reliable, and bug-free, Quality Assurance engineers conduct manual and automated tests.

At Syndicode, we integrate testing throughout the development process, conducting checks concurrently with development and performing an overall evaluation after the primary components of the marketplace application are assembled. This approach accelerates development while maintaining high quality.

After the launch, it’s crucial to keep the development team accessible for bug fixes and enhancements based on user feedback. Continuous monitoring and responsiveness to user input help to refine and improve the marketplace, ensuring it remains effective and competitive in the market.

How to create a marketplace that will gain traction?

We know. We have built plenty of marketplace solutions that got the attention of customers and investors

See casesChallenges of creating a marketplace website

Throughout a decade of creating marketplaces, Syndicode has faced numerous challenges alongside its clients. Here are some of the most common ones.

However, with effective planning and equipping your marketplace with the right features, these challenges can be overcome:

Balancing supply and demand

Achieving a balance between supply and demand can be difficult, particularly for new businesses. Market fluctuations and competition can further disrupt the balance between sellers and buyers in a marketplace, affecting the user experience and impeding marketplace growth.

But how to create a marketplace website and avoid this challenge? Consider implementing features like flexible fee structures, dynamic pricing, built-in analytics tools, user-friendly seller onboarding processes, and consistent technical maintenance.

Quality control

The diversity of the seller base, competition, and ever-growing customer expectations can make it difficult to ensure consistent quality of goods and services on an online platform. Regular quality checks are necessary to ensure that sellers adhere to the platform’s quality policies.

Furthermore, allowing buyers to rate sellers and leave reviews for products and services can improve user experience, enabling informed decision-making. Implementing dispute resolution mechanisms can further boost satisfaction.

Changing market dynamics

Online commerce is inherently dynamic, with user preferences changing as quickly as weather. To achieve success, a marketplace must remain responsive to these changes by adjusting its offerings, marketing strategies, and user experiences accordingly.

A scalable infrastructure and integrations that enhance your marketplace’s capabilities can help overcome this challenge.

How much does it cost to build a marketplace?

The marketplace development cost is determined by two equally significant factors:

- Marketplace functionality. How you create a marketplace is probably the most crucial factor in cost calculations. If you want to create a marketplace website with complex and unique functionality, be ready to pay a higher price for a completed solution.

- Location of the vendor. Hourly rates for software development services can vary widely based on the location of the vendor. Generally, rates in Western Europe or North America are higher than those in Eastern Europe, which tends to offer more cost-effective solutions.

Here is a rough correlation between the location of software developers and their rates:

| Country | Average hourly rates |

| The USA | $100-120 |

| Western Europe | $70-90 |

| Eastern Europe | $50-70 |

To provide a rough estimate, let’s consider the development of a simple B2C marketplace. Keep in mind that this is a basic estimation, and actual costs can vary based on specific project requirements and geographic factors. You can find a more detailed breakdown in our blog post about marketplace development cost calculation.

| Functionality | Development time, h | Cost, $ | |

|---|---|---|---|

| Best-case scenario | Worst-case scenario | ||

| Seller and buyer profiles | 140 | 280 | 7,000-14,000 |

| Admin profile | 70 | 140 | 3,500-7,000 |

| Product listing with seller tools for management | 280 | 420 | 14,000-21,000 |

| Search and filter options | 280 | 420 | 14,000-21,000 |

| Product page with images and text descriptions | 140 | 280 | 7,000-14,000 |

| Payment management | 280 | 560 | 14,000-28,000 |

| Basic analytics | 280 | 420 | 14,000-21,000 |

| Notifications | 140 | 280 | 7,000-14,000 |

| Total | 1,610 | 2,800 | 80,500-140,000 |

Please note that this is a general estimate, and the actual development time may be longer or shorter depending on how exactly each of the features should be implemented. Moreover, the price may differ too, depending on your development team’s rate.

How much will marketplace development cost you?

Provide a description of your project, and our representative will return to you with an estimate.

Contact usMarketplace website development in a nutshell

We hope that this comprehensive guide answers your question about how to build a marketplace app. Let’s summarize the key steps:

- Planning: define your niche and target audience, outline core features, and set your budget.

- Choose a business model: decide if your marketplace will be B2C, C2C, or B2B, and establish revenue streams (e.g., commissions, subscription fees). Create a value proposition.

- Design and develop: create an intuitive UI/UX design for user-friendly navigation. Then, build the platform, incorporating user profiles, product listings, search functions, payment processing, and admin tools.

- Testing: rigorously test the site for functionality, security, and usability.

- Launch and maintain your marketplace: go live and promote your business. Continuously improve, address user feedback, and ensure security.

Apparently, building a marketplace can seem a challenging task. Still, things start looking very promising if you have a reliable software development company to take up your project.

Syndicode employs experienced specialists who will build a unique and powerful solution to help your marketplace business thrive. We value careful planning and transparent communication, and this approach helps us deliver products that attract millions in investments months after launch.

Frequently Asked Questions

-

Why marketplace business model is so popular now, and how they outperform competitors?

The first reason for building a marketplace is the diversity of revenue strategies. There are many monetization models to choose from: commission, membership, listing fees, advertisements, etc. Second, online marketplaces are known for their quick expansion. Provided that everything is working fine from the beginning, the number of buyers and sellers will be increasing rapidly. Finally, since marketplace owners do not have inventory, they are free from any issues that come with its management. The same goes for delivery or logistics. Vendors are dealing with these processes. The marketplace owner is responsible for providing an online platform that connects buyers with sellers.

-

Why do entrepreneurs outsource marketplace website development to Eastern Europe?

To start with, Eastern European countries such as Poland, Hungary, Slovenia, and others face the rapid growth of the IT industry. It is further fueled by Ukrainian developers who relocated to these countries, having brought their skills to the market. Another important reason to build a marketplace website with an outsource web development company that employs specialists from Eastern Europe is the best value/quality ratio. Though our software developers set lower rates than their North American or Western European colleagues, the quality of their services is pretty high. Finally, 85% of Ukrainian software developers have a high level of English proficiency.

-

Why do companies choose Syndicode to build a custom marketplace website?

Syndicode has been building marketplaces since 2014. Over these years, we have built dozens of e-commerce platforms of any complexity for a number of industries. All of them paid off quickly and turned into profitable businesses. In addition, we have accumulated vast experience in holding discovery sessions successfully. It means that we have learned to collect the basic requirements from customers and offer them the most suitable technical solutions in a fast and convenient way. This approach allowed us to define how to build marketplaces that both meet specific customers’ demands and bring value to the end-users.

-

How to create marketplaces that attract sellers and buyers?

To ensure that your new marketplace is appealing to the target market, research the market and take note of competitors’ offerings. But don’t simply create a website like Amazon. Instead, take the best from it like a trendy, intuitive, and user-friendly user interface, and data security practices, and add unique features. Next, make your value proposition clear and ensure it caters to the needs of your audience. Finally, promote your marketplace through marketing campaigns, advertising, referral programs, and partnerships, leverage SEO, and, of course, collect feedback and act on it.

-

What is the difference between a marketplace and an e-commerce platform?

While both marketplaces and e-commerce platforms are used for buying and selling goods and services, there is a difference between their business models and operation modes. Thus, sellers or vendors in a marketplace typically offer a variety of goods and services in different categories. Most marketplace platforms earn revenue by charging a commission on each sale. E-commerce platforms tend to focus on a particular product category, such as electronics, fashion, or software. They generate revenue through product sales, subscription fees, or a combination of both.

-

Do I need technical skills to build a marketplace website?

While having technical skills can certainly be beneficial, you don’t necessarily need them to build a marketplace. You can hire a team of experienced developers who specialize in marketplace app development to handle the technical aspects of your project.

-

What is the cost of developing a marketplace mobile app?

The cost of developing a marketplace mobile app can vary depending on factors such as the complexity of the app, the platform (iOS, Android, or both), the number of features, and the development team’s rates. Development costs for a marketplace app can range from a few thousand to hundreds of thousands of dollars.