The financial world is undergoing a cloud revolution, with major banks leading the charge. Notably, JPMorgan Chase & Co. now runs over 70% of its data on private or public cloud platforms, regularly increasing its technology investments.

But what about smaller financial institutions with tighter budgets?

A Bank Director report shows that 75% of U.S. banks with under $100 billion in assets are growing their tech budgets. Similarly, American Banker reports that most banks have moved over half their IT infrastructure to the cloud and plan to increase this to two-thirds within a year.

These developments highlight a pivotal trend: financial institutions, large and small, are increasingly turning to the cloud. If your organization is exploring this move, too, this article will guide you through the benefits, uses, and tips for cloud adoption.

By the end, you’ll have a clear understanding of how cloud solutions transform banking—and whether it’s time for you to make the leap.

What is cloud computing in banking?

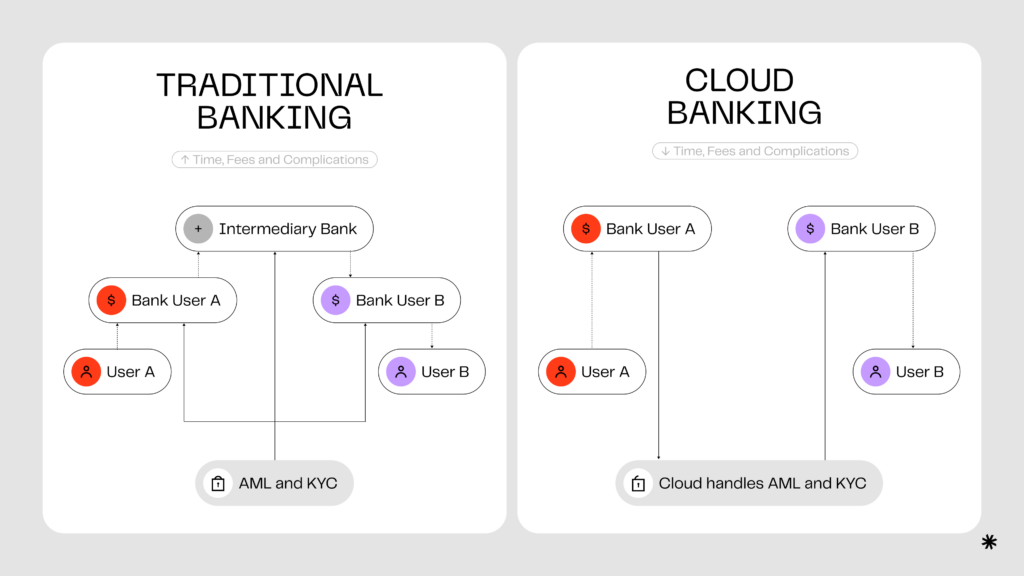

Cloud computing refers to the use of internet services to store, manage, and process data, rather than relying on local servers or in-house IT infrastructure. In the banking sector, cloud computing makes it easier to run critical services such as:

- Checking and managing accounts;

- Processing payments and transfers;

- Storing customer information securely;

- Tracking customer needs and offering better services.

By leveraging cloud solutions, financial services can work faster and more reliably, make smarter evidence-based decisions, and quickly adapt to new challenges—all while maintaining compliance with regulatory requirements.

Key benefits and use cases of cloud computing in banking

Adapts quickly to demand changes

Cloud platforms can automatically increase or decrease computing power and storage based on the workload. This helps them perform well no matter how many users or how much data is being processed.

The pay-as-you-go pricing adds to this efficiency, allowing companies to pay only for what they use.

For instance, Citi has named cost savings as one of the benefits of its modernization efforts, which included cloud migration.

Interestingly, while many organizations partner with cloud providers, others opt for custom solutions. Bank of America, for example, developed its own cloud banking system, saving $2 billion annually, according to its CEO.

Enables support of AI, ML, and blockchain

On-demand scaling gives access to powerful computing, making it easier to process and analyze data in real time, which is essential for advanced technologies. Cloud providers also offer ready-made tools for AI and blockchain, making these technologies simpler to use.

For example, Bankwell Bank invested in a generative AI-powered virtual assistant to extend customer service beyond traditional hours. According to the bank’s chief innovation officer, offering banking services on the cloud simplified the loan process for customers and helped the bank make more loans.

Read how Syndicode used gen AI to automate and enhance user satisfaction in EdTech

Simplifies data protection and compliance

Advanced infrastructure, distributed data centers, and economies of scale allow cloud providers to offer advanced security features. Many cloud computing platforms for banking are also compliance-ready, meeting financial regulations like PCI DSS and GDPR. All this helps financial businesses stay compliant without needing to build expensive infrastructure.

However, it’s important to remember that cloud providers follow a shared responsibility model. This means they handle the security and compliance of the infrastructure, while clients remain responsible for securing their data, applications, and user access within the cloud.

Just switching to cloud banking, therefore, doesn’t automatically guarantee data safety or compliance—it requires ongoing management.Since small and mid-sized banks often lack dedicated IT teams, partnering with a trusted cloud development provider is a smart way to fully benefit from the cloud.

Modernize without betting the bank

Syndicode has just the expertise to help you migrate away from outdated legacy systems. As your end-to-end partner, we handle everything—from implementation to ongoing support and technical guidance. Contact us today to get started!

Contact usPrevents fraud

Late 2024 was marked by the failure of The First National Bank of Lindsay, driven by fraud. While it’s unclear whether the fraud stemmed from outdated legacy systems or poor governance, it’s certain that cloud computing and advanced tools could have helped mitigate or detect it earlier.

For instance, advanced analytics tools can flag inconsistencies or unusual patterns in financial records. Built-in logging and audit capabilities ensure all changes are recorded and traceable, making it harder to alter records unnoticed. Additionally, automated compliance checks help identify reporting discrepancies before they escalate.

Improves business continuity

Banks are prime targets for cybercriminals, and recent bank failures highlight the critical need for strong business continuity planning.

Cloud systems store data across multiple locations, significantly reducing the risk of downtime, even during unexpected events. Additionally, many cloud providers offer built-in disaster recovery solutions, ensuring a secure and reliable environment for financial institutions.

Syndicode’s experience in cloud banking development

Syndicode has been actively helping BFSI companies optimize their resources and improve customer satisfaction. Our recent collaboration with the digital mortgage platform Maxwell shows how cloud tools can reduce manual work, speed up operations, and improve communication with customers.

With the help of cloud technology and our experts, Maxwell’s platform became even more efficient. It now offers customers clearer, faster reports and insights to make smarter decisions with ease.

Smart route to cloud migration

Avoid costly mistakes and wasted resources with a well-planned cloud migration strategy. Partner with Syndicode’s experts and step into digital modernization with confidence!

Let’s talkBest practices to implement cloud computing in banking

Cloud computing has proven to be highly beneficial for banks. For example, Philippine Security Bank started moving to the cloud in 2022 and, within two years, said its digital strategy had positioned it to become the most customer-focused bank in its region.

Still, many banks face challenges, with over a third struggling to connect cloud banking solutions with their existing systems.

To help your company move to the cloud smoothly, we’ve created a simple workflow based on our research and experience.

1. Assess needs and objectives

Transforming a company that’s spent years building strong customer relationships can feel overwhelming. Where do you even start?

At Syndicode, we begin by understanding your needs and goals for cloud migration. We also look at how cloud adoption aligns with broader business goals, such as improving customer experience or meeting compliance. This step directly shapes the migration roadmap, which we tailor to fit each company’s unique circumstances.

Next, we review your current IT systems to see how ready they are for migration. Some older systems might not work in the cloud and may need to be replaced before your company can become a fully cloud-based banking platform.

These planning and auditing activities help estimate the resources needed and provide a realistic timeline for the migration.

Keep in mind that moving to the cloud often means changes within the company. Teams may need to adopt new workflows and work more closely together to make the transition a success.

2. Choose the right cloud model

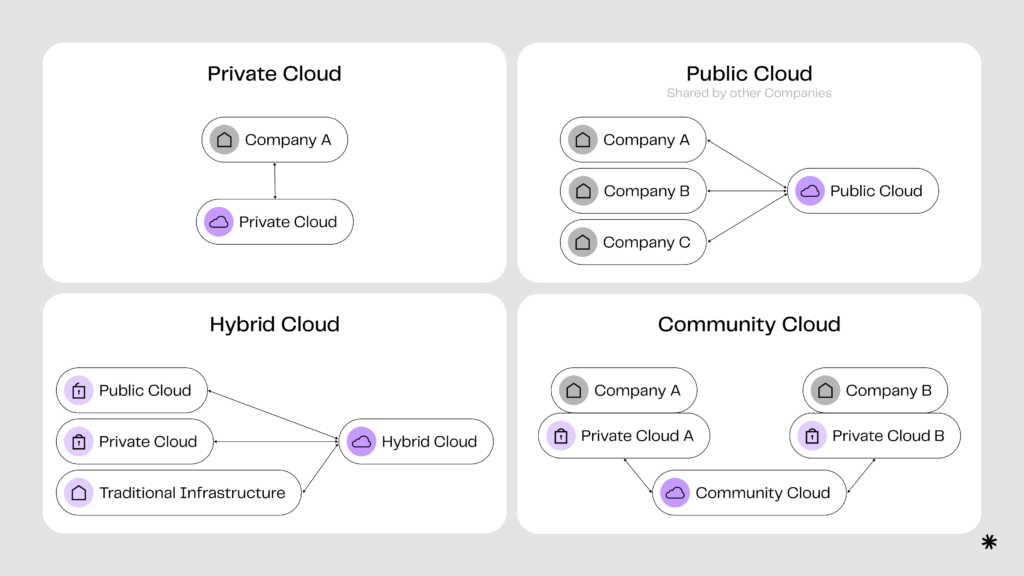

Depending on your bank’s goals, budget considerations, and growth plans, some cloud computing models will be more beneficial for banking than others. Below, you can see the comparison between the four major cloud models used by BFSI companies big and small.

| Cloud model | Description | Key features | Use case for banks |

|---|---|---|---|

| Private Cloud | Dedicated solely to one organization | High control, Enhanced security, Compliance with regulations | Ideal for sensitive regulated workloads like customer data and financial records |

| Public Cloud | Cloud resources are shared among multiple users | Scalable, Cost-effective, Flexible, Limited control over the infrastructure | Suitable for less-sensitive workloads, such as testing environments, email services, or public-facing applications |

| Hybrid Cloud | A mix of private and public cloud models | Balances control and scalability | Perfect for banks transitioning to the cloud or managing complex workloads with varying sensitivity levels |

| Community Cloud | Shared by multiple organizations | Combines shared costs with industry-specific needs | Rarely used in banking, but could benefit smaller institutions looking to share resources |

3. Select a cloud provider

There are clear leaders in cloud computing services for financial institutions and banks, and we’ve summarized them in the table below. However, if you’re exploring other cloud providers, keep these factors in mind:

- Not all providers meet crucial standards like PCI DSS, GDPR, or local data residency requirements—verify their certifications;

- Ensure the provider’s strengths (e.g., AI capabilities, hybrid cloud support, or analytics tools) align with your bank’s specific needs;

- Assess how well the platform integrates with your existing systems and workflows to avoid compatibility issues;

- Consider the provider’s partner network, technical support quality, and tools to simplify the migration process.

| Cloud provider | Key strengths | Use cases |

|---|---|---|

| Amazon Web Services (AWS) | Highly customizable, Industry-leading scalability, Extensive partner ecosystem, Multiple certifications (PCI DSS, GDPR) | Core banking applications, Fraud detection with AI/ML, Risk modeling and analysis |

| Microsoft Azure | Leader in hybrid cloud solutions, Trusted in enterprise environments, Built-in tools for data residency and compliance | Regulatory reporting, Customer relationship management (CRM), Hybrid cloud implementations |

| Google Cloud Platform (GCP) | Best-in-class data analytics, User-friendly AI/ML tools, Competitive pricing for analytics-heavy workloads | Real-time fraud detection, Customer insights through data analytics, Scalable data lakes |

| IBM Cloud | Tailored for regulated industries, Excellent for hybrid and multi-cloud environments, High focus on data protection | Hybrid cloud for legacy system integration, AI-powered financial insights, Risk management |

| Oracle Cloud | Specialized in financial services, Deep expertise in databases and ERP, End-to-end integration for banking software | Core banking system modernization, Compliance tracking, Data analytics for financial insights |

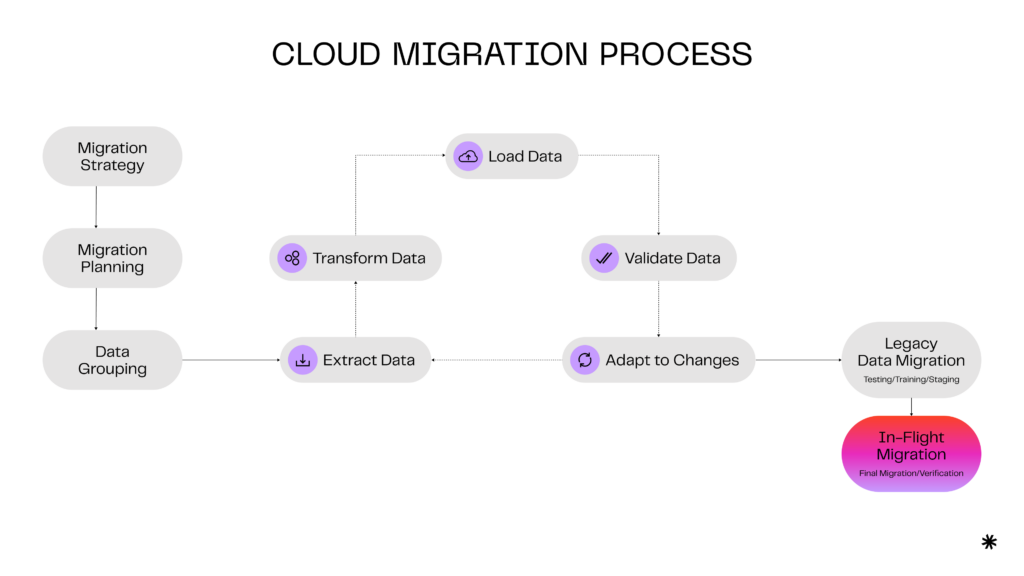

4. Migrate in phases

Phased migration is a great approach for BFSI companies because it allows them to embrace cloud technologies gradually and reduce risks. The process starts by moving non-critical workloads to the cloud. These are analyzed to gather insights that help plan the next steps.

Next, moderate-risk workloads that don’t need instant availability are migrated. These systems often need to communicate with on-premises infrastructure, so the migration team must set up APIs and ensure seamless data flow between the systems.

Finally, critical operations are broken into smaller parts and migrated with strict security measures like encryption, identity management, and audit logging. These systems are thoroughly tested to make sure they perform reliably.

While this method sounds simple, it involves ongoing support and risk management tasks, such as backing up data, setting up disaster recovery systems, and testing performance after each phase. API development services might be needed to maintain smooth communication between migrated systems and those still running on-premises.

For critical operations, running systems in parallel during migration is often necessary to ensure business continuity. Some downtime may still happen, so the migration team needs to work closely with other departments and stakeholders to keep everyone informed and minimize disruptions for customers.

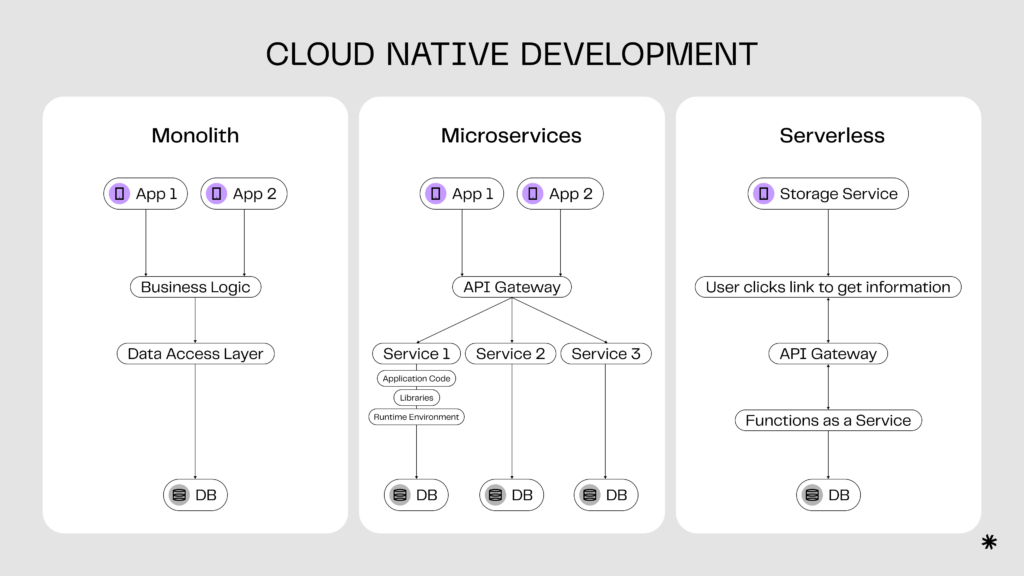

4. Adopt cloud-native development practices

If you want to get the most out of the transition to cloud banking, you’ll need to adopt cloud-native technologies. They are specifically designed to maximize the flexibility, scalability, and efficiency of cloud environments.

While it’s possible to transfer banking services onto the cloud without these technologies, doing so often leads to significant limitations that can undermine the migration’s value.

Let’s explore the key cloud-native technologies:

Microservices

Microservices break applications into smaller, independent components, each handling a specific function (e.g., payments, customer profiles, or fraud detection).

This design allows each service to scale independently based on demand, improving efficiency. It also enhances resilience—if one service fails, the rest of the application remains functional.

Additionally, microservices make it easier for IT teams to develop, test, and deploy features without affecting the entire application.

Learn more about how to break down an application using microservices

Serverless computing

Serverless computing enables banks to run code on demand without needing to manage or provision servers. Banks only pay for the compute resources used during execution, avoiding the costs of idle servers.

Besides, with infrastructure managed by the provider, developers can focus solely on writing business logic, allowing them to roll out features faster.

Containerization

Containers bundle an application and its dependencies into a lightweight, portable unit, using fewer resources than traditional virtual machines.

Containers also run consistently across different environments, making it easier to update applications without downtime.

6. Train teams and foster a cloud culture

Another survey found that 65% of banks that started their cloud migration are held back by organizational policies.

One of the biggest challenges with cloud adoption is shifting from siloed work—where departments operate independently—to a collaborative approach. Employees may hesitate to share knowledge to protect their roles. Additionally, teams may need upskilling or training to effectively use cloud tools and analytics for decision-making.

From what we see, organizations that succeed with cloud banking adoption usually have strong leadership support. This top-level commitment ensures that, once the decision to migrate is made, every choice in the organization aligns with a cloud-first strategy.

Starting small and progressing gradually, as outlined in earlier steps, helps reduce fear, uncertainty, costs, and risks. It also gives employees time to understand the reasons behind the migration and see the benefits of cloud computing in financial services.

Additionally, during the transition, companies can use the time to identify skill gaps and provide tailored training programs to prepare teams for the change.

Finally, if your organization lacks confidence in handling the migration alone, partnering with experienced vendors and technology providers is a smart move. They will support the entire cloud migration process, from planning to execution, smoothing out the transition.

Architectural, service, and computing models in the cloud

Earlier, we discussed private, public, hybrid, and community clouds. In your research on cloud models, you might also come across terms like IaaS, PaaS, SaaS, serverless computing, and centralized, decentralized, and federated architectures.

We’ll try to clear up the confusion:

- Private, public, hybrid, and community clouds are deployment models that describe where cloud resources are hosted and who owns, manages, and has access to them;

- IaaS (Infrastructure-as-a-Service), PaaS (Platform-as-a-Service), and SaaS (Software-as-a-Service) are service models that define the type of service cloud platforms provide—ranging from infrastructure for developers to ready-made software solutions;

- Centralized, decentralized, and federated are architectural models that describe how systems, data, and decision-making are structured. For example, control can be centralized in one location or distributed across multiple systems.

Migrate with an experienced partner

Syndicode is here to simplify your cloud journey. With our expert team, we’ll design, build, and scale the perfect cloud solutions for your business. Let’s get started today!

Set up a callCommon challenges of cloud adoption in financial services

We’ve already touched on some of the key challenges BFSI companies face when implementing cloud technology and the best ways to handle them. Now, let’s look more closely at the obstacles banks often run into when planning their migration.

Challenge 1: Data security and privacy

Banks handle highly sensitive information, and a data breach can lead to financial loss, reputational damage, and regulatory penalties. While cloud computing is no more prone to breaches than traditional IT systems, it requires careful configuration and proper management of shared infrastructure to ensure security.

Cloud providers catering to BFSI companies address this challenge by implementing extra security measures, such as:

- Advanced data encryption, access management tools, and multi-factor authentication to secure sensitive information;

- Compliance certifications like PCI DSS, GDPR, ISO 27001, and SOC 2 to meet regulatory requirements;

- Continuous monitoring and threat detection, often powered by AI and machine learning, to identify and respond to risks in real time;

- Disaster recovery and data backup across multiple locations to ensure business continuity.

It’s equally critical to have an experienced team that understands how to configure and use these tools effectively.

Challenge 2: Meeting regulatory requirements

Many regulations mandate that sensitive data, such as customer information, remain within specific geographical regions, which can limit the choice of cloud providers. Additionally, the lack of direct control over IT cloud infrastructure, the cloud’s dynamic nature, and a limited understanding of the shared responsibility model can complicate real-time auditing and reporting.

Fortunately, many banking-focused cloud providers offer built-in tools for auditing and compliance. However, it’s essential to ensure they also provide region-specific data centers to meet local regulatory requirements.

Partnering with a knowledgeable technology provider with expertise in cloud banking development is equally important. Such a partner can guide you through compliance challenges, help configure your cloud environment correctly, and ensure your cloud strategy aligns with industry standards.

Challenge 3: Legacy system integration

Legacy systems were often built using monolithic architectures, outdated programming languages, or hardware-dependent designs, making migration to cloud banking both challenging and costly. These systems can pose issues with data integrity, downtime, and performance during migration.

To mitigate these challenges, look for a cloud provider that offers:

- Support for legacy applications: Tools such as virtual machines (VMs), containerization, and hybrid cloud solutions;

- Elastic scaling: The ability to handle fluctuations in workloads seamlessly;

- Integration capabilities: Options to keep certain workloads on-premises while gradually migrating others to the cloud.

In addition to choosing the right cloud provider, a development partner is critical to managing the complexities of legacy system migration. They assess the legacy systems, create a tailored migration strategy based on the bank’s unique needs, and ensure the plan is implemented effectively.

Challenge 4: Skill gap and resistance to change

Change can be difficult, and resistance to it is one of the main reasons banks delay their digital transformation. To overcome this challenge, it’s essential to ensure that key stakeholders are on board and that a clear strategy is in place. This strategy should outline how decisions will be made after committing to migration, taking into account cloud-specific features like shareability and collaboration.

Major cloud providers, such as AWS, Microsoft, and Google Cloud, help bridge the skill gap by offering role-based training programs and certifications tailored to BFSI companies.

An experienced development partner can complement these efforts by offering hands-on support and expertise. They provide confidence to newly trained IT teams and tailor the migration strategy to align with the bank’s specific goals and capabilities.

Challenge 5: Cost predictability

The pay-as-you-go model provides flexibility, but if not managed carefully, costs can quickly spiral out of control. To prevent this, it’s essential to accurately estimate resource needs before migration and select appropriately sized resources for your workloads.

A trusted cloud development partner can play a vital role in managing costs effectively. They will help develop a tailored cost strategy, implement cost monitoring tools, and establish governance policies.

Additionally, they will regularly optimize workloads by identifying and shutting down unused or idle resources, ensuring that cloud spending remains under control.

Making cloud work for your business with Syndicode

At Syndicode, we understand the top concerns banks face—ensuring data security, maintaining compliance, controlling costs, and modernizing legacy systems. We provide end-to-end cloud development support, guiding you through every step—from planning and migration to ongoing optimization.

Our company values focus on building long-term partnerships, where your success is our priority. We take full ownership of our work, ensuring that the solutions we deliver are secure, cost-effective, and tailored to your needs.

Let us help you navigate the complexities of cloud banking adoption with confidence. Fill out the contact form today, and let’s work together to unlock the full potential of your cloud strategy.

Frequently asked questions

-

What cloud service providers do you work with?

We work with leading cloud services for banks, including Amazon Web Services, Microsoft Azure, and Google Cloud Platform. These platforms are widely trusted in the banking industry for their robust security, scalability, and compliance capabilities. Depending on your needs, we recommend and implement the provider best suited for your specific requirements.

-

What tools or technologies do you use for cloud-native development?

For cloud-native banking development, we use modern tools like Docker and Kubernetes for containerization, Terraform for Infrastructure-as-Code, and CI/CD pipelines with tools like GitLab CI or Jenkins. We also leverage serverless computing frameworks (e.g., AWS Lambda) and monitoring tools (e.g., Prometheus, Grafana) to ensure scalability, efficiency, and reliability.

-

What is your development process, and how do you ensure timely delivery?

Our process includes requirement analysis, planning, development, testing, deployment, and ongoing support. We use Agile methodologies, breaking projects into manageable sprints with clear milestones. This approach enables us to adapt to changes and deliver results efficiently. Regular progress updates, close collaboration with clients, and thorough testing ensure we stay aligned with goals and meet deadlines. For a deeper look into how we work, check out our earlier blog post about our software development process.

-

How do you ensure cost transparency?

We provide detailed cost breakdowns at the start of the project and track the project using time-tested project management tools like Jira. Regardless of the chosen cooperation model, our clients receive regular updates on the project progress and spending.

-

How do you ensure compliance with local and international financial regulations?

We prioritize compliance by working with cloud providers that meet industry standards like PCI DSS, GDPR, ISO 27001, and SOC 2. Additionally, we configure your cloud banking environment to align with local laws, including data residency requirements.