Online banking apps are becoming increasingly essential for businesses in the financial sector. With benefits like convenience, security, and efficiency, it’s no surprise that more companies are creating desktop, web, and mobile banking solutions. But how do you make your own banking app?

Building a banking app isn’t a simple task—it requires careful planning, a solid tech stack, and a deep understanding of user needs. From making sure the app is secure and compliant to designing an intuitive user experience, there’s a lot to consider.

At Syndicode, we’ve been down this road before, successfully delivering secure and efficient banking apps. So, if you’re asking, “How do I make a banking app?”—we’ve got the insights and experience to guide you through the process. Keep reading to learn the essential steps and tips to build a banking app that resonates with users and keeps your business ahead of the curve.

Before starting the banking app development project

Before you jump into developing a web or mobile banking application, it’s important to take a step back and clarify your vision. This will make it easier to find the right development partner and explain your idea to them. It’ll also make the planning stage quicker and smoother.

1. Decide what you want your app to do

How a banking app is built—and what it looks like—depends mostly on its purpose. For example, a digital wallet app needs to support different payment methods and offer contactless transactions. Because speed and convenience are key, the design should be simple, fast, and easy to use with just one tap. There’s no room for a cluttered or complex interface since users need to make payments quickly.

On the other hand, a cryptocurrency app has more features and must balance strong security with ease of use. These apps usually include many screens and educational guides because crypto transactions can be complicated, and the industry is always changing.

Different types of online banking applications also use different technologies, which means they require different skills from banking app developers. That’s why it’s important to clearly define what your app needs to do before starting mobile banking development or even creating a prototype.

To help kickstart your ideation process, here’s an overview of the major types of banking solutions, and best mobile banking app examples, along with their key features and intended purposes.

| App Type | Example | Purpose | Essential Features |

|---|---|---|---|

| Digital Wallets | Apple Pay, Google Wallet | Store payment methods and enable quick, contactless transactions. | NFC/contactless payments, QR code payments, card/token storage, transaction history. |

| Money Transfer Apps | Venmo, Zelle, Wise | Facilitate fast domestic or international money transfers. | Bank account linking, real-time transfers, currency conversion, recipient management. |

| Online Bank | Chime, Revolut | Provide full banking services without physical branches. | Account creation, deposits/withdrawals, bill payments, transaction history. |

| Investment & Trading Apps | Robinhood, E*TRADE, Binance | Allow users to buy, sell, and manage investments in stocks, crypto, or other assets. | Real-time market data, order execution, portfolio tracking, secure login. |

| Personal Finance & Budgeting Apps | Mint, YNAB, PocketGuard | Help users track spending, set budgets, and analyze financial habits. | Bank account sync, expense categorization, budgeting tools, financial insights. |

| Loan & Credit Apps | LendingClub, SoFi, Affirm, Credit Karma | Provide personal or business loans and credit management. | Loan application, credit scoring, repayment tracking, interest calculation. |

| Business Banking Apps | QuickBooks, Square, Revolut for Business | Offer financial management tools for businesses. | Multi-user access, invoicing, payroll processing, tax management. |

| Cryptocurrency & DeFi Apps | MetaMask, Trust Wallet, Binance, Crypto.com | Enable users to buy, sell, store, and trade cryptocurrencies or interact with DeFi services. | Wallet management, blockchain transactions, private key storage, smart contract interaction. |

2. Look at regulations

Licensing and compliance for banking apps can be complicated, especially in the USA. For money services, you may need an MSB license, and the rules can vary by state. If you build a banking app that offers loans, it may need FDIC insurance and must follow OCC rules. Trading apps must follow SEC regulations, and so on.

Before you start mobile banking software development, it’s important to understand what licenses your app will need. This will help ensure your development team builds it in a way that meets all the necessary legal requirements.

For reference, below are the key components of an app architecture as required by the Anti-Money Laundering (AML) policy:

| AML component | Description | Features a banking app needs |

|---|---|---|

| Customer Identity Verification (KYC) | The app should verify the identity of users before allowing them to send, receive, or exchange money. | Document verification, Biometric verification, Integration with global watchlists, Compliant backend system |

| Transaction Monitoring | The app needs to be able to detect suspicious patterns of behavior. | Automated alerts, Data analytics, Real-time transaction data analysis mechanisms |

| Record-Keeping and Reporting | The app should safely store transaction histories and user data. | Automated transaction data logging, Suspicious activity reporting, Encrypted data storage with role-based access control |

| Risk-Based Approach | The app must be designed to evaluate user risk profiles based on specific factors. | Risk profiling engine, Integration with global watchlists |

| AML-compliance dashboard | The app should provide compliance officers with a dashboard to interact with the system. | Admin interface with tools to review flagged transactions, create reports, Data encryption & secure access mechanisms |

3. Choose the technologies to build a banking app

There isn’t a single best tech stack for building a banking app; the choice depends on your preferences and the skills of your development team. That being said, some programming tools may work better for specific needs or features.

Let’s take a look at a few backend technologies as examples:

| Technology | Pros | Cons | Common use case |

|---|---|---|---|

| Java | Scalable, secure, and highly reliable; Great for microservices architecture; Supported by major frameworks with lots of pre-built functionalities | Can be complex and slower to develop compared to other languages | Enterprise-level applications |

| Node.js (JavaScript/TypeScript) | Asynchronous and non-blocking I/O; Single language stack for both front-end and back-end | Might struggle with complex, transaction-heavy applications; Callback hell and performance issues if not architected well | Apps that deal with a lot of real-time data or requests |

| Python | Great for rapid development; Integrates well with AI/ML tools; Good for data processing | Can be restrictive when building high-performance applications; Not ideal for highly concurrent or transaction-heavy workloads | Prototypes; Fraud detection features; Automated customer support features or chatbots |

| Go (Golang) | Great for speed and scalability; Ideal for microservices architectures | Few pre-built libraries for financial apps due to the small community | Apps that handle large amounts of concurrent requests |

| C# (ASP.NET) | Powerful for building secure and scalable systems | Can be restrictive for some use cases due to a lack of flexibility | Enterprise-level applications |

Not sure how to start your banking app development?

Our experienced team is here to help. We offer business discovery services to refine your app idea, align it with market needs, prioritize key features, select the best tech stack, and create a clear development roadmap. Let’s turn your vision into a structured plan—get in touch with us today!

Contact usBasic steps to developing a mobile banking application

The key challenges that often determine the success of a web or mobile banking app development project are making sure your vision is clearly communicated to the development team and ensuring that vision stays intact throughout the entire process.

Often, what’s in your mind may not always be what the team understands, and it’s crucial to bridge that gap. Additionally, it’s important to validate that your ideas align with real-world needs and market demands.

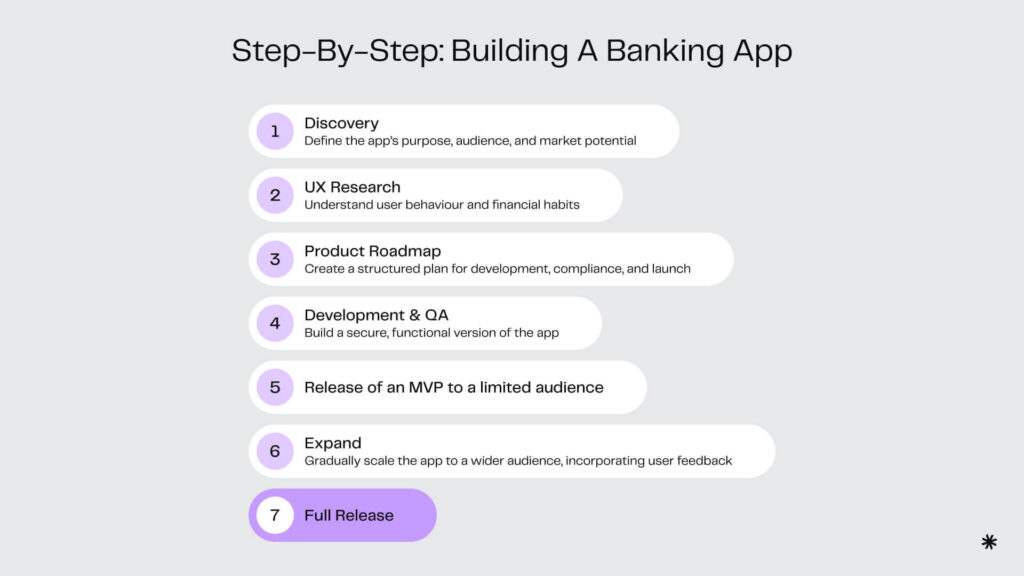

The following process is designed to help you collaborate with your development team effectively, ensuring that your ideas are translated into clear technical tasks that are both feasible and relevant to your target audience.

Step 1. Conduct a discovery workshop

Before writing any code, take time to understand your market and target audience. This helps ensure that the banking app you’re building meets user needs, follows regulations, and stands out in the market.

For market research, tools like Similarweb, Google Keyword Planner, Ahrefs, SEMrush, and Statista can provide insights into industry trends and user behavior. Additionally, surveys, interviews, and focus groups can give you direct feedback from potential users.

Key questions to answer during this phase:

- How big is your potential market?

- Can your target audience grow over time?

- Who are your competitors, and what are their strengths?

- What unique value does your app offer?

A discovery session also helps define your app’s features and compliance requirements early on. Understanding regulations from the start allows the development team to structure the app’s architecture, security, and data handling correctly.

Step 2. Do UX research

The next step of banking app development is to understand who you are building it for. Banking apps serve a wide range of users, from teenagers to seniors, but their needs and behaviors vary significantly.

For example:

- Younger users (under 24) primarily use mobile banking software for purchases, tuition payments, and small money transfers. This group represents the largest portion of mobile banking users.

- Older users tend to rely on banking apps for bill payments, cash flow management, and larger transactions.

Instead of trying to serve everyone, focus on the most profitable user segment. Analyze key characteristics such as age, income, occupation, and spending habits to create an Ideal Customer Profile (ICP).

This research helps you:

- Understand user needs – What are their financial habits and pain points?

- Prioritize features – Which functions are essential for your core audience?

- Optimize the user experience – Ensure smooth navigation and accessibility for your primary users.

- Reduce risks – Address security concerns and compliance needs specific to your audience.

As your app evolves, your customer base may change. Regularly revisiting and refining your ICP ensures your app stays relevant and continues to meet user expectations.

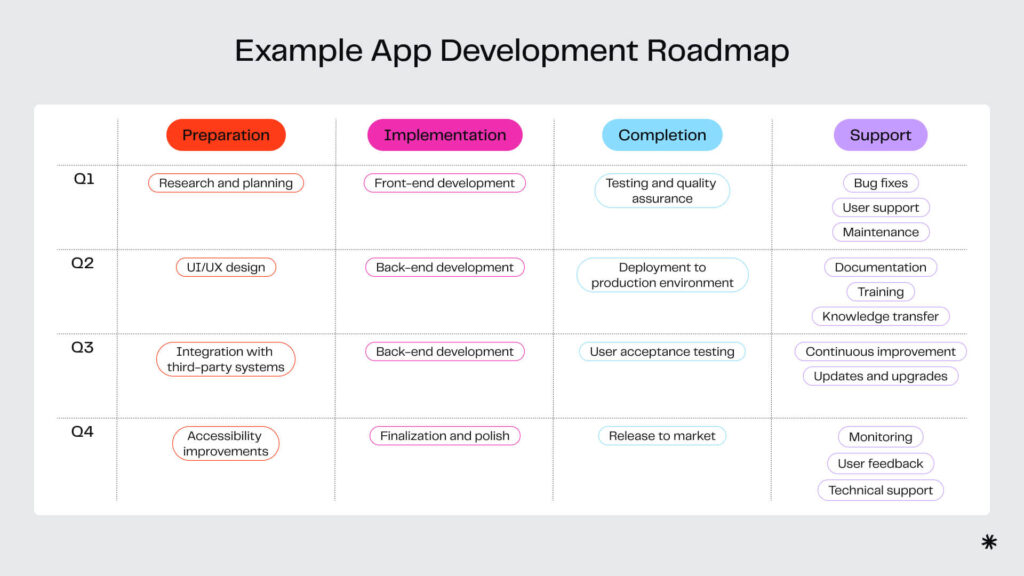

Step 3. Create a product roadmap

A roadmap is a plan that outlines the entire process of building a banking app, from idea to launch and beyond. It acts as a guide, setting clear goals, timelines, and key deliverables to keep the project on track.

When working with a software development company, both you (as a client) and your development partner have important roles:

Your role:

- Define the business vision and goals

- Provide market insights and target audience information

- Engage with stakeholders & investors

Development partner’s role:

- Turn your vision into a technical strategy

- Ensure compliance with financial regulations

- Choose the right architecture & technology stack

- Build a secure, scalable, and reliable banking app

Here’s what a roadmap for building a banking app could look like:

Phase 1: Discovery & planning

Key activities:

- Market research & competitor analysis

- Defining the target audience (Ideal Customer Profile)

- Regulatory & compliance research (e.g., AML, KYC, PCI-DSS)

- Feature prioritization & defining the app’s unique value proposition

- Choosing the technology stack

- Creating initial wireframes & prototypes

Outcome:

- A clear product vision

- A compliance checklist

- A high-level project timeline

Phase 2: Design & prototyping

Key activities:

- UI/UX design focusing on accessibility & security

- User journey mapping to ensure smooth navigation

- Creating interactive prototypes for stakeholder feedback

Outcome:

- A clickable prototype

- A refined feature list

- Stakeholder alignment on the app’s look & feel

Phase 3: Development & compliance implementation

Key activities:

- Backend & frontend development (integrating banking APIs, payment gateways, security layers)

- Ensuring regulatory compliance (AML, KYC, GDPR, etc.)

- Implementing fraud detection & risk management features

Outcome:

- A working MVP (Minimum Viable Product)

- A security-tested infrastructure

Phase 4: Testing & refinement

Key activities:

- Security & compliance audits

- Load testing & bug fixes

- Beta testing with a small group of users

Outcome:

- A stable, compliant banking app ready for launch

Phase 5: Launch & continuous improvement

Key activities:

- App store deployment

- Gathering user feedback & monitoring performance

- Implementing new features & regulatory updates

Outcome:

- A fully functional app with ongoing updates for security & usability

Step 4. Build an MVP & iterate

An MVP is a simplified version of your banking app that includes only the core features necessary for launch. This approach is recommended for new banking app development because it allows you to get a working product to market faster and helps ensure your vision is on track.

To build a banking app MVP, it’s best to focus on the most important features first, like ACH transfers. However, even though MVP development is just a starting point, it still needs to be a fully operational financial product that meets strict security and compliance requirements. You can’t afford to launch with gaps in fraud protection, encryption, or regulatory compliance, as these are key to gaining user trust.

Nonetheless, an MVP isn’t a full public launch. It’s meant to be tested by a small, controlled group of real users, such as:

- Early adopters who are open to trying new solutions

- Beta testers who provide structured feedback

- Existing customers (if you already have a financial product or service)

- Industry partners or business clients (for B2B banking apps)

- Internal teams (employees, stakeholders, or advisors)

Once the MVP has been tested and improved based on this initial feedback, you can gradually roll it out to a wider audience, continue monitoring its performance, and make adjustments before the full-scale release.

Step 5. Expand your audience and engage in feedback loops

Once your MVP has shown success (even if you made a few adjustments based on early feedback, that’s normal), it’s time to introduce it to a larger audience.

To keep feedback manageable and ensure the app works well in real-world conditions, we recommend starting with a small group—around 100 to 1,000 users—and gradually expanding from there. This approach lets you continue building the banking app based on actual use while keeping the process cost-effective and low-risk.

Cost of banking app development

On average, finance app development costs start at $100K–$500K, but the final price can be much higher depending on the project’s complexity and whether or not you outsource the development. The thing is, building a banking app is a complex process that can take anywhere from several months to multiple years. For instance, creating a mobile payment app from scratch could easily take over a year for a dedicated development team of six developers.

One way to speed up the development of banking apps and reduce costs is to use a BaaS (Banking-as-a-Service) platform as the foundation and then work with a custom software development company to white-label it or add specific features. However, BaaS solutions come with limitations on customization, so it’s important to ensure they align with your needs before committing.

If you’re trying to estimate the cost of developing a banking app, you’ll need to consider several factors:

- App complexity – The more interconnected features and workflows, the more time and expertise required;

- Technology stack – Some technologies are better suited for specific features but may take longer to develop;

- Target platforms: Building a smartphone banking app for multiple operating systems can take longer. For instance, iOS app development is generally considered easier than Android app development;

- Third-party integrations – The number and type of APIs integrated into the app can impact development time;

- Team size and structure – Larger teams can speed up development but are harder to manage. A well-organized online banking software development company often delivers results faster than a group of freelancers;

- Location of developers – Developers in the U.S. typically charge more than those in Eastern Europe, even for the same level of quality.

You can look up software development rates to estimate costs yourself or schedule a free consultation with our team for a more precise estimate tailored to your project.

Syndicode’s experience in developing FinTech apps

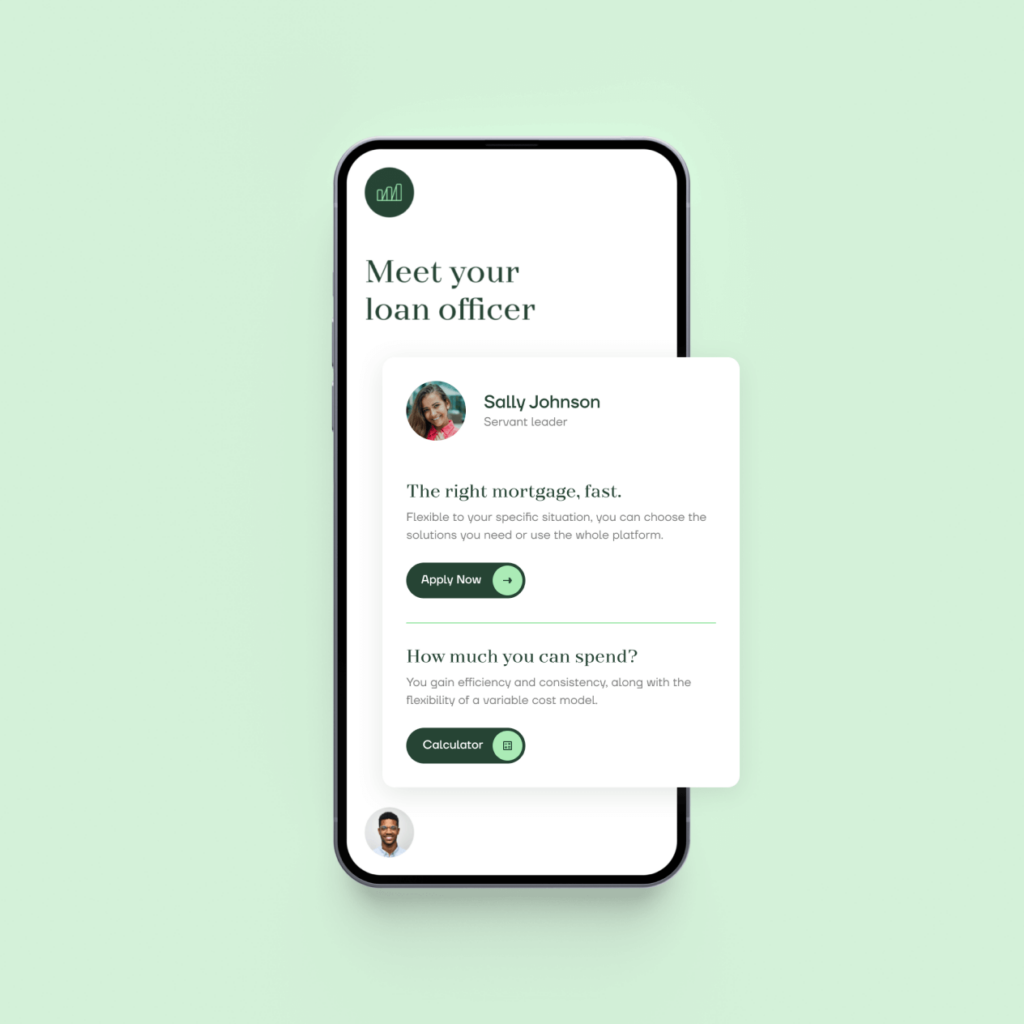

We’ve had our fair share of projects involving creating banking applications. Here’s a look at one so you could better understand our approach.

With Maxwell, we stepped into the world of real estate fintech, creating a platform that connects lenders with real estate professionals for smooth and efficient transactions. The focus was clear: simplifying the mortgage process for everyone involved.

Our team designed a seamless, user-friendly interface that allows professionals to easily manage and track their deals. We also integrated powerful tools for document management, enabling users to store and access essential files securely.

The real magic was in the platform’s automation—Maxwell helps reduce manual tasks and boost productivity, saving time for lenders and professionals alike.

The results? Maxwell now uses half the resources it did before our involvement, all while maintaining top performance and speed. It’s rapidly gaining user trust, helping thousands of real estate professionals close deals faster.

Common challenges in digital banking app development

Web and mobile application development for the banking industry presents its own set of technical and regulatory challenges. Here are some of the key considerations:

Tech challenges

- User-friendly interface: Regardless of the platform, a banking app’s interface should be easy to navigate for users of all ages and technical backgrounds. Designing a clean and intuitive experience that works across different devices and screen sizes can be tricky.

- Payments blocking capability: The app should allow the bank to connect instantly to a customer’s account system, enabling quick actions such as blocking cards to prevent fraud or money laundering activities.

- Authentication methods: For web and desktop applications, implementing secure authentication methods (like biometrics or two-factor authentication) must be seamless and accessible on all devices. On Android, the challenge lies in ensuring the app works across a range of devices, while desktop apps may need to integrate multiple authentication technologies.

- Data storage & security: Ensuring that sensitive user data is handled correctly is critical for both web and desktop apps. All data downloaded or received by the app should be cleared when uninstalled. Additionally, this data should be protected from any physical retrieval in case of a breach, which is especially important for desktop apps where data may be stored locally.

Regulatory challenges

- Compliance: Banking apps must meet the regulatory requirements of the region they operate in. For example, in the EU, this includes compliance with GDPR, PCI DSS, SEPA, and PSD2 regulations. In the US, there are a range of privacy, fraud prevention, anti-terrorism, anti-money laundering, and state-specific laws to adhere to.

- Third-party integrations: Developing apps for banks often requires integration of third-party services but involves contracts with each provider. These agreements can affect project timelines as one needs to ensure that compliance standards are maintained across all integrations.

Wrapping up

Well, now you know how to build a banking app. It involves much more than just development—it’s about creating a strategic plan, designing with the user in mind, and ensuring top-notch security. Whether you’re developing for mobile, web, or desktop, a banking app must stay relevant and user-friendly with regular updates. By following the insights shared here, your business can build a banking app that resonates with users, enhances their experience, and drives success in the digital banking world.

If you’re ready to bring your banking app idea to life, consider teaming up with experienced experts like Syndicode. Our team of developers, designers, business analysts, and other specialists is here to guide you through every stage, from research and development to launch and beyond. We also offer IT consulting services to help you optimize development costs and improve user experience.

Reach out today to discuss your project!

All the specialists you need, all in one place

From idea to launch and beyond, Syndicode covers the entire banking app development process. We design, build, and maintain secure, high-performance banking solutions, so you don’t have to juggle multiple teams. Let’s build your app together—schedule a call today!

Let’s talkFrequently asked questions

-

What is a banking app?

A banking app is mobile or web software that allows users to manage their finances digitally. It lets people check account balances, transfer money, pay bills, and even deposit checks from their phones or computers. Digital-only banking applications provide a convenient way to handle everyday banking tasks without visiting a physical branch. They often include features like security measures, such as password protection or biometric login, to keep users’ information safe. Some apps also allow users to track spending, apply for loans, or invest in financial products, all from their devices.

-

What are the requirements for web and mobile banking app development?

Building a banking app involves meeting several technical, regulatory, and security requirements. First and foremost, strong encryption, secure login methods (like biometrics or two-factor authentication), and fraud protection are essential to keep users’ financial data safe. The app must securely handle personal and financial information, including managing user consent. Compliance with regulations such as GDPR, PCI DSS, and local laws like the US’s Dodd-Frank Act or Europe’s PSD2 is a must. The app should also be scalable to accommodate growing user demand and increased transactions over time. In addition, the design needs to be user-friendly, easy to navigate, and accessible to people of all ages and tech abilities. Seamless integration with banks, payment gateways, and third-party services is crucial for smooth transactions. Before releasing your app—even to a limited audience—rigorous testing is required to ensure it operates smoothly and is free from bugs or vulnerabilities. Finally, continuous updates and bug fixes are necessary to maintain security, compliance, and overall functionality.

-

What is the difference between mobile banking and internet banking?

Mobile banking and internet banking both allow you to manage your finances online, but they differ in the devices you use. Mobile banking is done through an app on your smartphone or tablet, offering more convenience and features like push notifications and location-based services. Internet banking, on the other hand, is accessed through a web browser on your computer or laptop. Both provide similar services like checking balances, transferring money, and paying bills, but mobile banking platforms are designed for on-the-go access, while internet banking is typically used from a fixed location.

-

How long does it take to build an online banking app?

The exact duration depends on the project size and whether you start from scratch or upgrade an existing solution. Other factors that affect the development timeline are the team composition, experience, tech stack, the targeted operating system, and how well the requirements were determined before the project started. For an average project, it may take 6—9 months and more to build a banking app MVP from scratch. However, you should consult your software development vendor to get an individual estimate for your case. They will also explain how to make a mobile banking app with the least investment.

-

When did mobile banking start?

Mobile banking began in the late 1990s and early 2000s, with the first mobile banking services being offered through SMS. In 1999, the first mobile banking app was launched by a Finnish bank, and soon after, other banks followed with similar services. However, the widespread adoption of mobile banking as we know it today really took off with the rise of smartphones in the late 2000s. The first digital-only banking app was launched in the UK in 2011, marking the beginning of an era where mobile banking became more accessible and advanced. It introduced features like fund transfers, bill payments, and account management—all directly from your phone.