Maxwell

Digital mortgage platform automation and enhancement

An innovative digital tool that streamlines and improves the loan process for mortgage lenders and borrowers alike. With Syndicode software development, Maxwell reached 200% improvement in resource utilization.

Services

- Staff Augmentation

- Ruby on Rails Development

- Application Development

- Web Development

- Digital Transformation

- AI Development

Technologies

- Ruby on Rails

- React

- Javascript

- Python

- OpenAI

- AWS

- Heroku

- Terraform

About the client

A well-established American digital mortgage company recognized the urgent need to scale its engineering team. This was necessary to meet the increasing demand for services and support expansion efforts as the platform rapidly gained traction in the market.

About the product

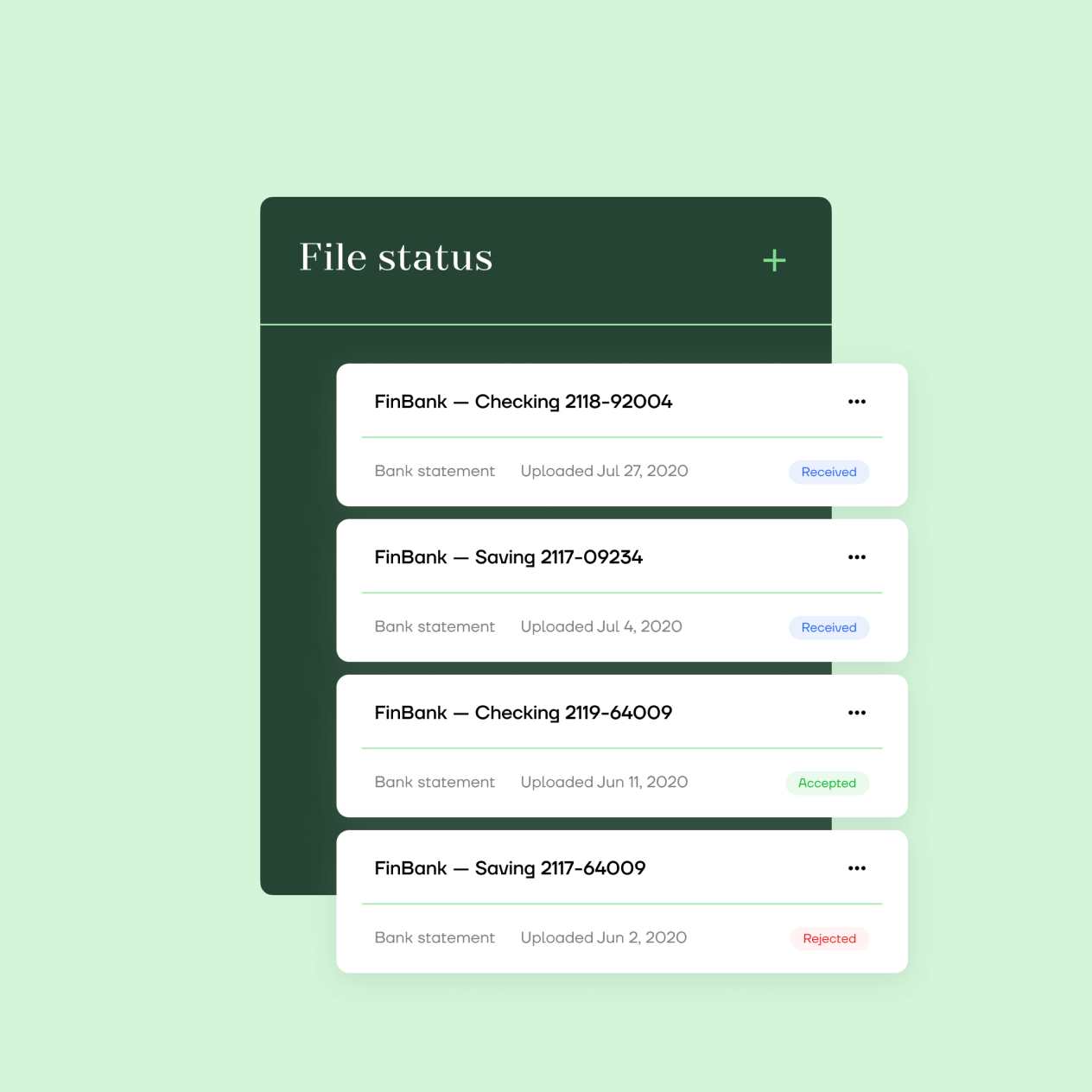

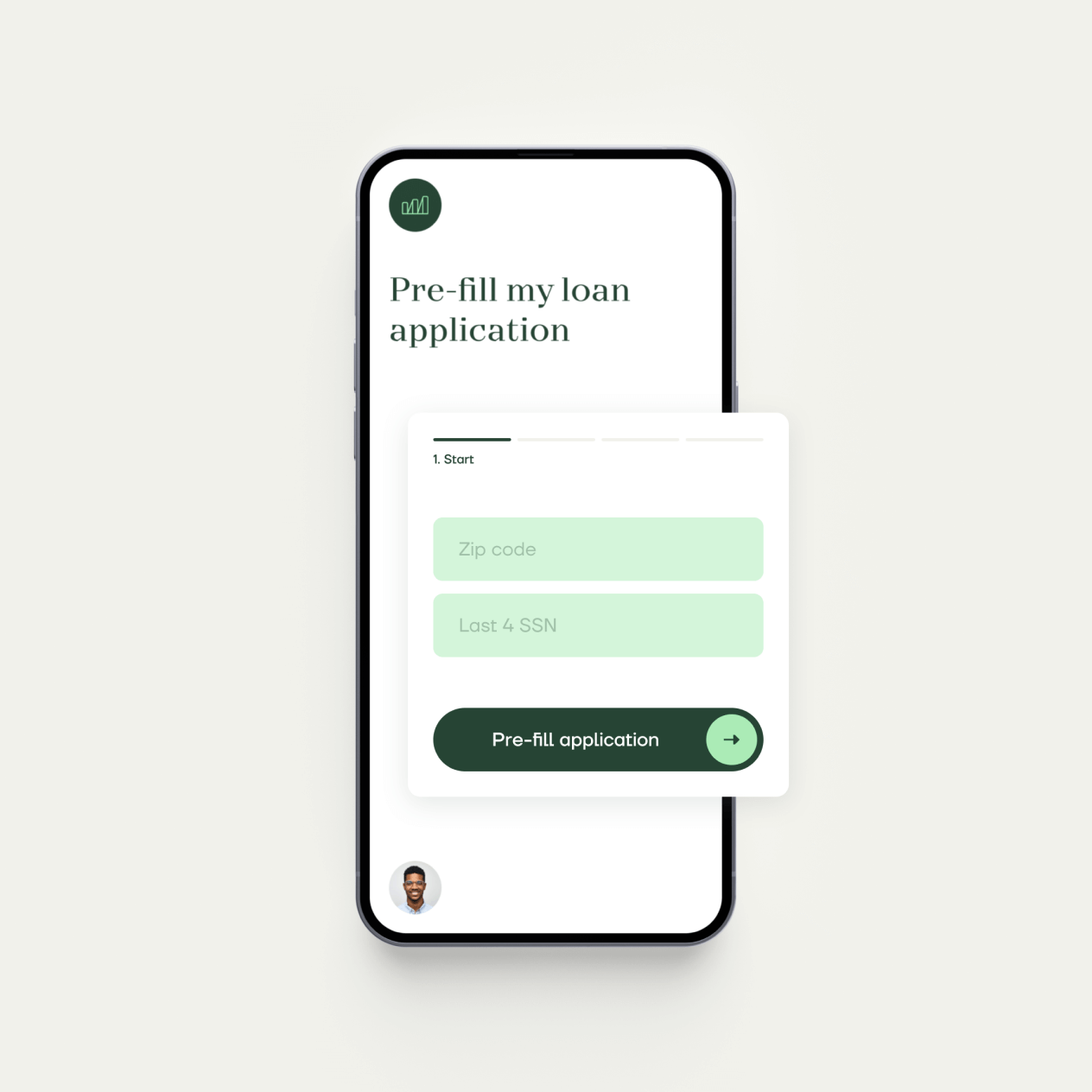

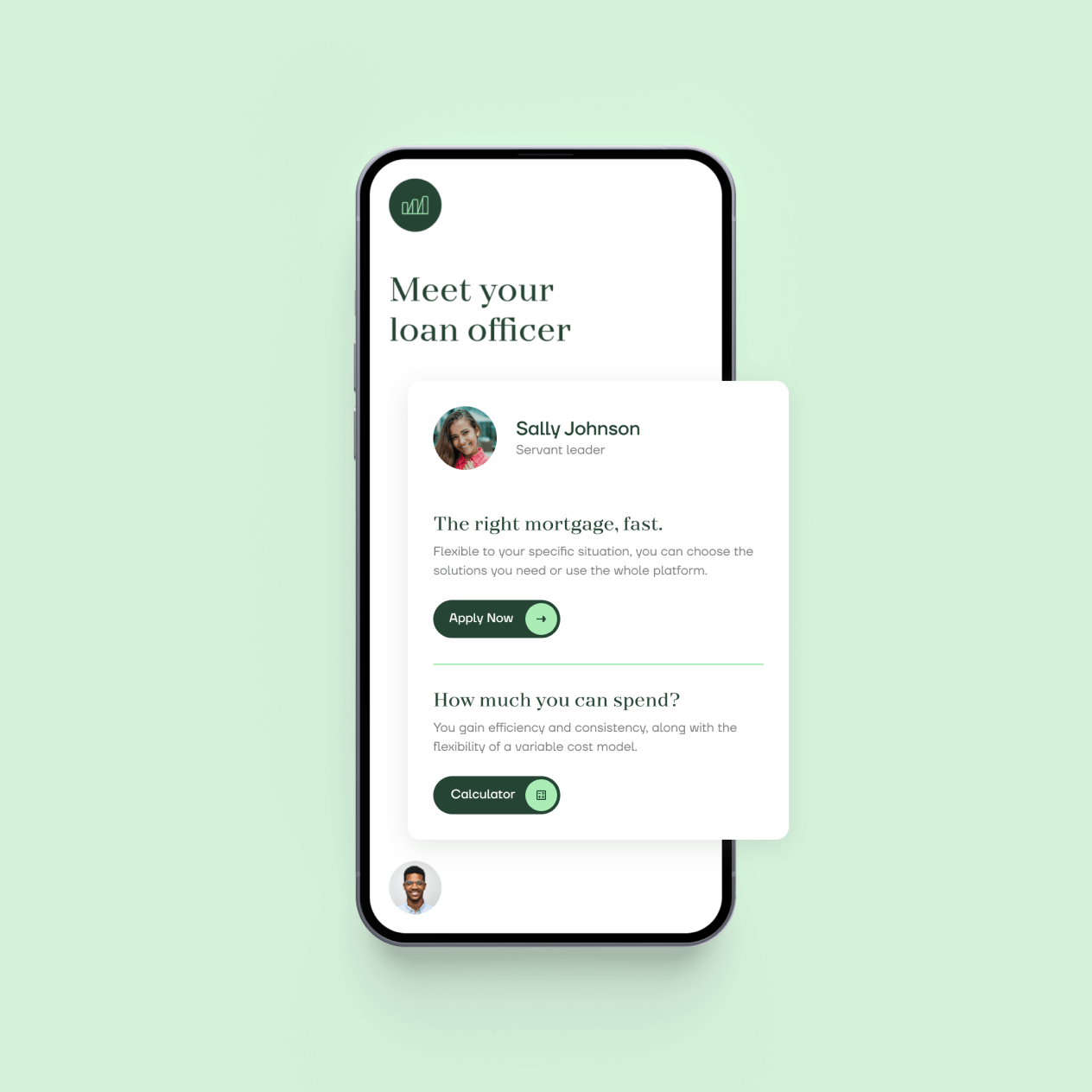

The Maxwell platform provides lenders and borrowers with a secure portal, offering a centralized and protected environment for managing loan applications. The solution is conveniently accessible from both desktop and mobile devices.

However, the platform faced challenges with inefficiencies in data management, communication, workflow automation, and system integrations. These obstacles hindered its ability to deliver a fully seamless and efficient digital mortgage solution.

View website

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Highlights

Solution delivered

Integrated AI-powered tools and improved system interoperability, having enhanced resource utilization by 200%.

Challenges overcome

Solved compatibility issues with third-party software, inefficient data sharing, slow communication, and data management challenges.

Business problem solved

Delivered a seamless and efficient digital mortgage solution. Improved overall productivity and decision-making.

Client’s challenges

Compatibility issues

Outdated integrations with third-party mortgage software solutions presented a high risk of disruptions in data sharing, resulting in workflow inefficiencies and decreased productivity for users.

Inefficient data sharing

A portion of Maxwell’s processes relied on manual data entry, increasing the risk of errors and duplicated efforts. This approach also resulted in delays and inaccuracies during the processing of loan applications.

Slow communication

Before partnering with Syndicode, Maxwell’s platform provided automated notifications and reminders through email or text messages to keep borrowers, loan officers, and agents informed throughout the loan lifecycle.

Despite being popular and effective communication methods, these channels lacked visibility, were susceptible to delivery delays, and proved inconvenient to manage.

Data management challenges

The lack of a comprehensive reporting system made it challenging for Maxwell’s lenders to access meaningful insights into client organizations, team performance, and market trends. This limitation hindered their decision-making processes and strategic planning efforts.

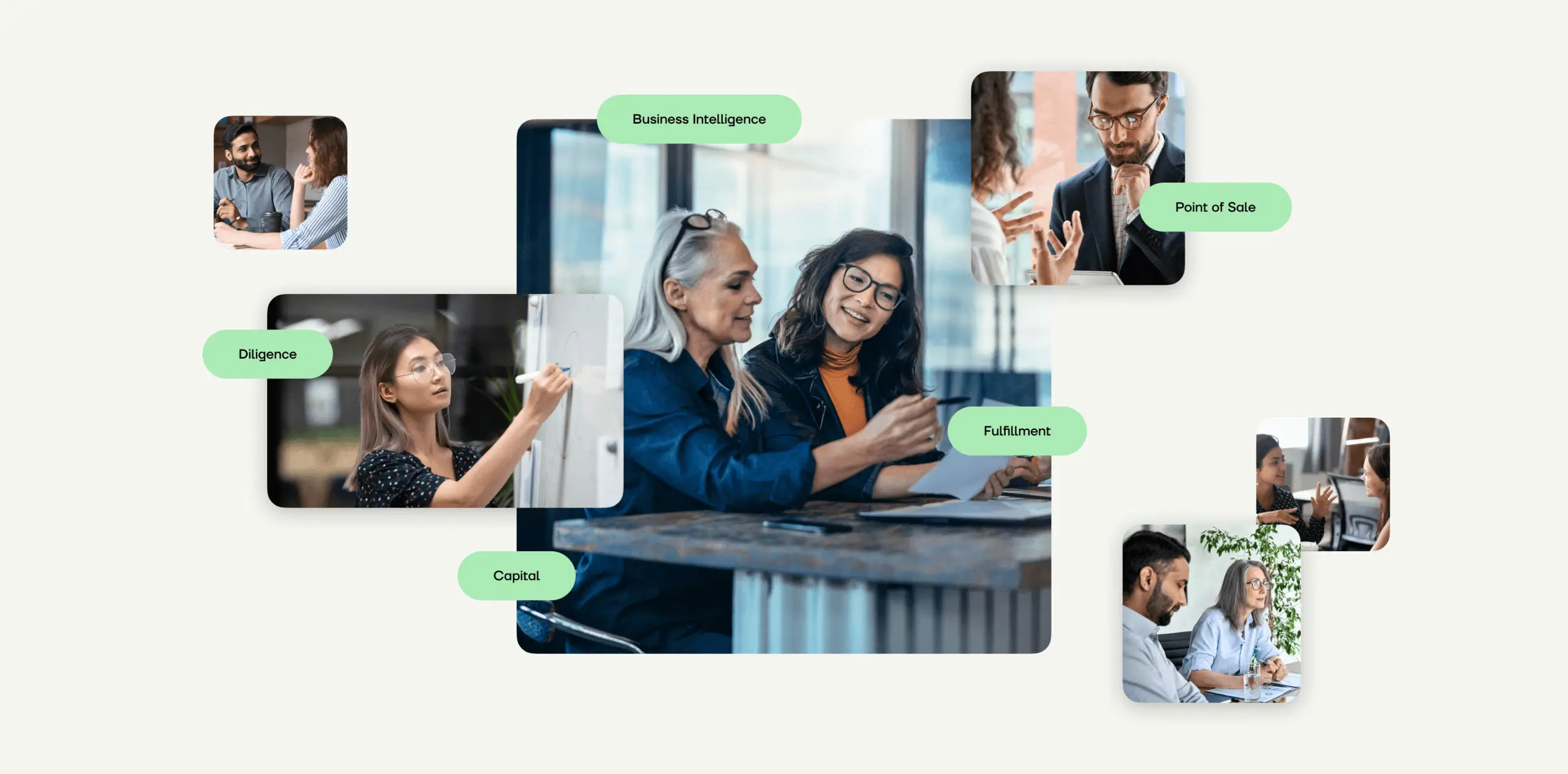

Our solutions

Syndicode joined Maxwell’s team to aid in platform maintenance, upgrades, and the development of new features. Here are some key highlights of our collaboration.

Data format standardization

Experts effectively addressed the compatibility challenges faced by the platform by aligning the loan application format with the Uniform Residential Loan Application (URLA) standard. This involved:

- Overhauling the backend of the Maxwell system to accommodate the new structure of the application;

- Updating the frontend (user interface) of the application to align with the changes in the URLA format;

- Ensuring that the data collected throughout the loan application process can now be exported in the standardized MISMO (Mortgage Industry Standards Maintenance Organization) format.

Overall, this enhancement significantly improved data sharing and communication with other systems, enhancing the platform’s efficiency and interoperability.

Integration enhancements and automation

We enabled seamless one- or two-way data synchronization between the Maxwell Loan Origination System (LOS) and other systems by implementing integrations and optimizing their performance. These integrations included:

- Byte LOS integration was built from scratch;

- Integra (from scratch);

- Encompass LOS integration has been extended by optimizing the performance of loan applications and documents between the systems. This involved mapping the documents generated in the POS system to corresponding document types in Maxwell’s LOS. Additionally, we implemented automation for role assignments.

- LendingQB/MeridianLink Mortgage integration has undergone a full refactoring and extension.

Custom integrations

We addressed the communication and data-sharing issues by integrating Maxwell with third-party systems essential to the mortgage lending process. These integrations facilitated seamless data exchange and automated workflows.

Key integrations included:

- Snapdocs integration was built from scratch;

- Upscope (from scratch);

- Finicity integration has been upgraded to the latest version;

- Plaid (upgrade).

Webhooks and push notifications

Syndicode improved the platform’s communication capabilities by enabling customers to subscribe to point-of-sale (POS) events directly from their web applications.

Moreover, we implemented push notifications on mobile devices to provide users with timely updates and alerts.

These enhancements not only improved real-time visibility but also heightened transparency into transactions and interactions.

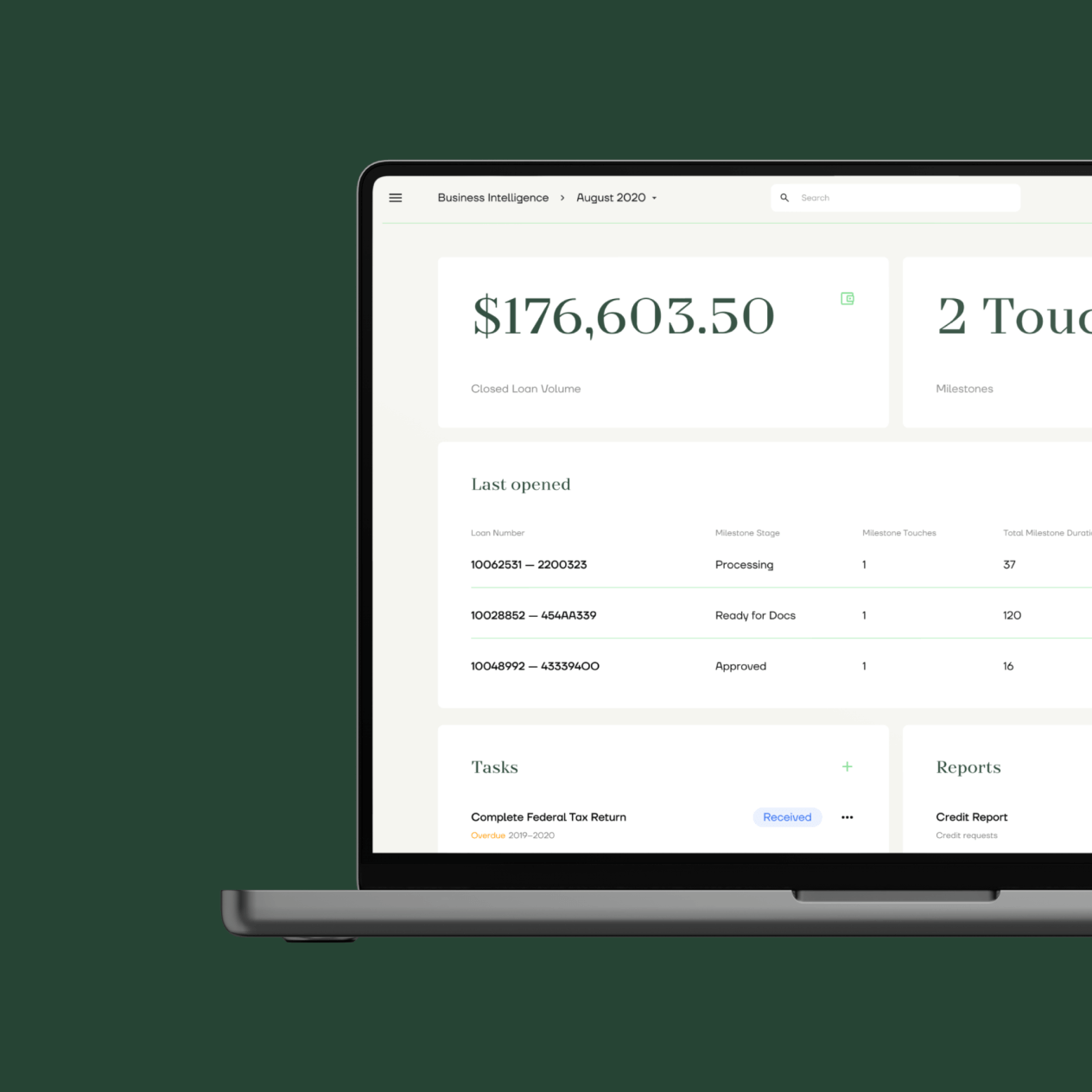

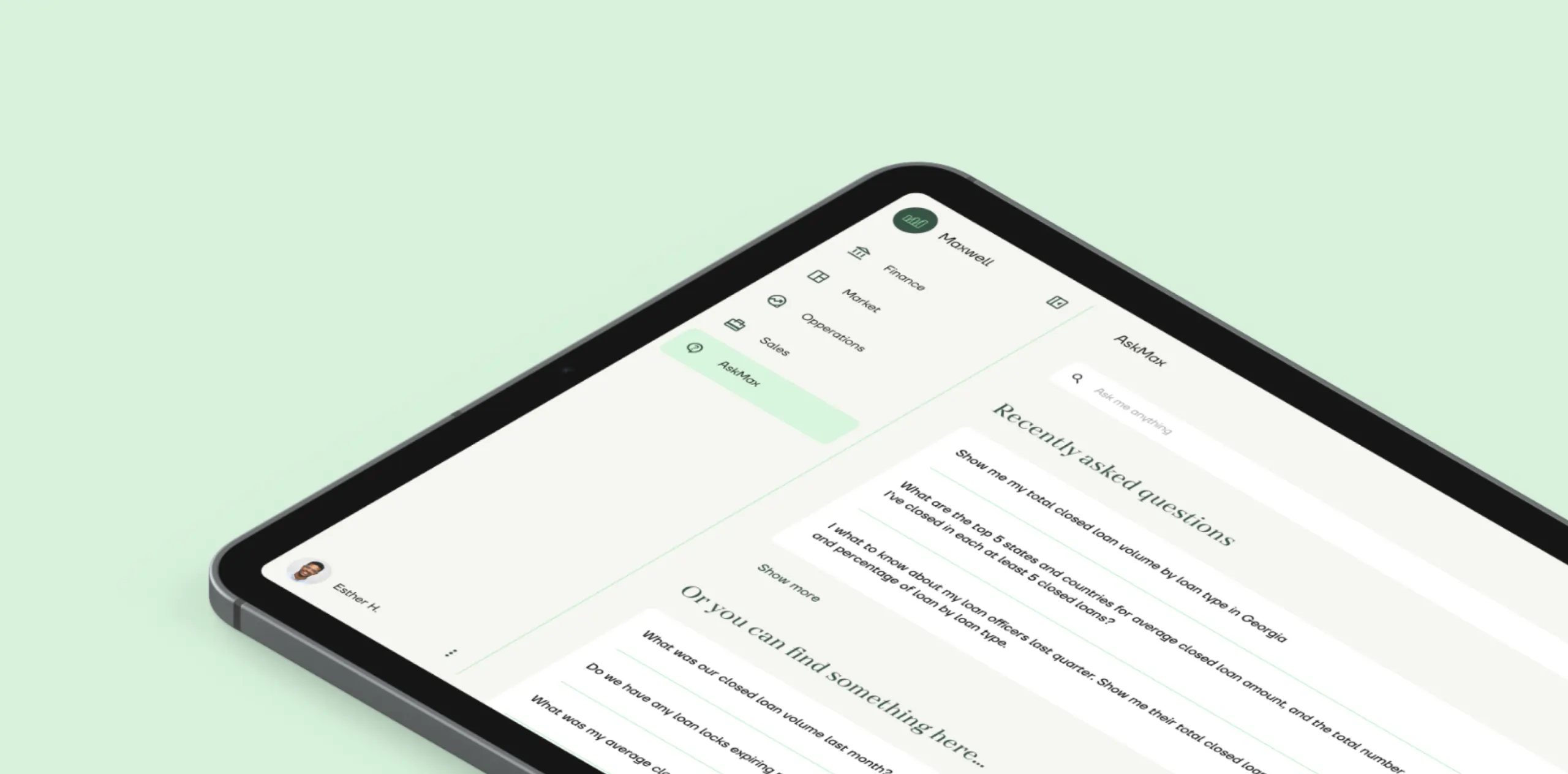

AI-powered report generator

We tackled data management challenges by introducing an AI-powered report generator. This innovative tool automatically produces relevant charts based on user queries, streamlining the process of data interpretation.

Additionally, we improved data accessibility and efficiency by providing dynamic visualizations of critical metrics and trends.

Furthermore, we implemented a structured report system that offers detailed insights into client organizations, teams, individual roles, and prevailing market trends.

Users can now generate and access reports directly from the admin panel, which significantly enhances visibility and facilitates informed decision-making.

Technical setup

/ Languages and frameworks: Ruby on Rails, React JS, Python

/ Infrastructure: AWS, Heroku, Terraform

/ AI models: OpenAI

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

Results

The integrations engineered by Syndicode have broadened the array of services offered by the Maxwell platform, minimised manual labor, heightened platform visibility, enhanced user experience, and boosted data accuracy.

Moreover, our implementations have optimised the document synchronisation process, resulting in improved data integrity and a 200% reduction in strain on system resources.

Next project

MedYouCate

Medical e-learning platform