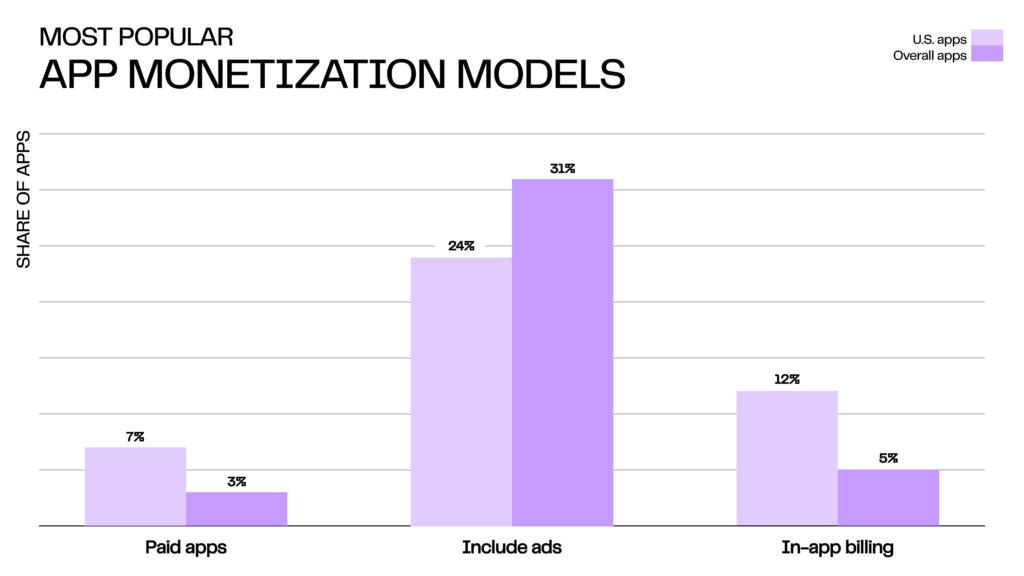

One in two mobile users has never paid for an app, according to Think with Google. Statista offers an even more dramatic insight: over 90% of apps across Google Play and the App Store are freely available.

Given that, it might seem like making your app free is the only way forward—and in many cases, it is. Why? Because free apps remove nearly all friction at the point of entry, making it far easier to acquire users, grow engagement, and compete in crowded marketplaces.

But launching your app is just the beginning. The real challenge comes next:

How do free apps make money?

That’s what this guide is here to answer.

We’ll explore:

- The most effective ways to monetize mobile apps used by top-performing companies

- Which monetization strategies work best for different app types (products vs. services)

- The tools and ad networks that help maximize your app revenue

- Real-world examples of free apps that make millions

- The latest app monetization trends you should be watching

Let’s dive in.

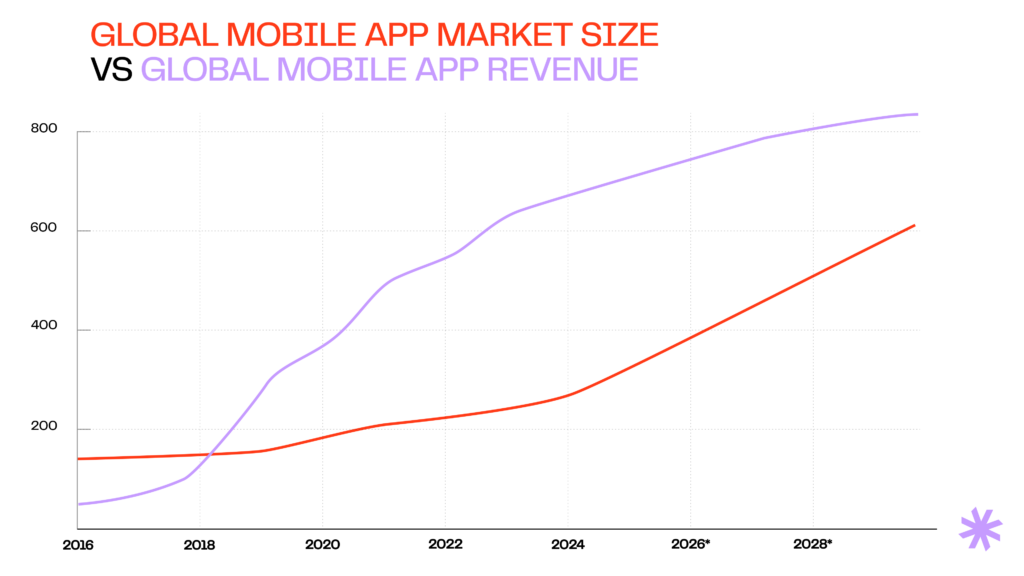

How much money can a free app make?

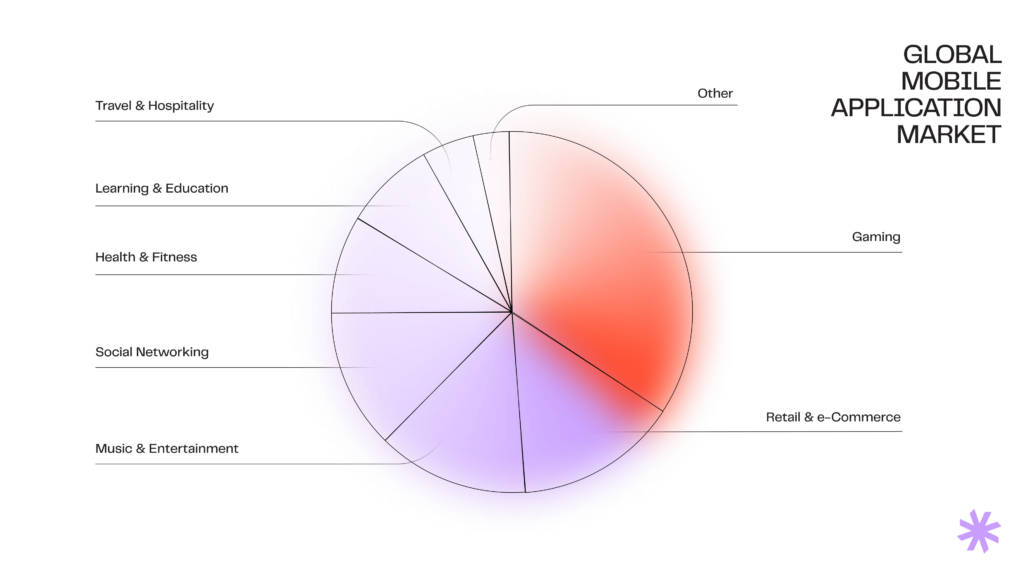

According to Statista, consumers spend an average of $5 per smartphone annually on mobile apps. The highest-grossing categories are games, social, photo and video, lifestyle, and productivity.

Research from RevenueCat shows that across all categories, the median monthly revenue for a subscription app one year after launch is $62–$92. On average, free apps reach their first $1,000 in revenue within about 60 days, though results vary significantly by niche.

If you’re considering ad-based monetization, an ad revenue calculator can help you set expectations. For example, Google AdMob estimates that a free app with 1 million monthly active users (MAUs) in North America could generate annual ad revenue of $50K–$280K, depending on the category:

| OS | App category | Annual revenue, $ |

|---|---|---|

| Android | Finance | 280,000 |

| Games | 50,000 | |

| Communication | 100,000 | |

| iOS | Finance | 268,000 |

| Games | 94,000 | |

| Communication | 94,000 |

Beyond in-app ads, another high-value opportunity is user data monetization. According to Vendia, selling anonymized datasets can bring in $22,500 to $57,500 per sale, depending on the nature and quality of the data.

What free app monetization models are there?

1. E-commerce & physical product sales

Under this model, a business sells tangible goods directly in the app, from branded merchandise to third-party items.

This can look like a dedicated in-app store with product galleries, integrated checkout, and shipping options. Some apps partner with suppliers for dropshipping, while others handle inventory directly.

Revenue comes from product markups, wholesale-to-retail margins, or dropshipping fees.

This works best for brand-driven apps or retail/lifestyle platforms with the infrastructure to manage inventory, logistics, and customer support.

Read also: How to build a marketplace?

2. Freemium model (paid features)

A freemium monetization strategy offers a free core version with premium features unlocked through payment.

In practice, this could be an ad-free upgrade, extra storage, advanced filters, or priority support. Users can subscribe to higher-tier plans or make one-off payments for add-ons.

Conversion rates vary by niche but can reach 30% if premium features deliver strong value.

This model is best suited for productivity apps, utilities, and creative tools where extra functionality significantly improves the user experience.

Read also: How to build an AI app?

3. In-app purchases (digital goods)

Businesses using the in-app purchases (IAP) model sell digital goods or unlockables, either consumable (like game currency, hints, or energy boosts) or non-consumable (like ad removal, premium themes, or permanent access to a course).

In games, this often appears as “loot boxes” or cosmetic upgrades; in education apps, it might be premium modules or certifications.

Gaming apps and those in media and educational categories are the top users of this model due to its flexible pricing and ability to let customers buy only what they value most.

4. Paid subscription model

Subscription apps charge recurring fees weekly, monthly, or yearly for premium access.

This could mean unlimited content streaming, exclusive workout plans, advanced analytics, or cloud backup services. Successful subscription apps frequently refresh content, run retention campaigns, and use push notifications to reduce churn.

The subscription model works best for content-heavy platforms, SaaS tools, and apps in fitness, education, and business services.

5. Transaction fees/commission

This model involves taking a cut from each transaction it facilitates. This could mean a percentage of sales in a marketplace, a booking fee on a travel app, or commission from peer-to-peer payments. The model scales naturally with user activity and transaction volume.

It’s ideal for e-commerce marketplaces, service booking platforms, and gig economy apps where large transaction flows occur.

6. In-app ads

Mobile apps working under this model show ads such as banners, interstitials, native placements, or rewarded videos.

This might look like a banner at the bottom of a news feed, a full-screen ad between game levels, or a rewarded video granting extra in-game currency.

To be profitable, this model needs a high-traffic app with a broad audience. Careful ad placement is key to maintaining a good user experience.

7. Sponsorships

Sponsorships involve partnering with a brand to promote its products or services inside your app in exchange for financial compensation.

This can take many forms: from displaying the sponsor’s logo on the app’s home screen to featuring branded content or integrating special features powered by the sponsor.

Sponsorship deals can be structured as a flat monthly fee, a revenue share based on conversions, or a combination of both, depending on the agreement.

7. Affiliate marketing

Affiliate marketing involves promoting third-party products or services and earning commissions based on clicks, views, installs, or sales.

In practice, this could be a curated “recommended tools” page in a productivity app, in-feed links to partner products in a content app, or game offers in a rewards app. The tracking and payments are usually managed through affiliate networks like Amazon Associates, CJ Affiliate, or Impact.

The model is best suited for niche content apps with engaged audiences, where trust and relevance drive high conversion rates.

8. SMS & text marketing

Apps that make money with this model collect user opt-ins to send promotional SMS campaigns. These messages might upsell premium services, cross-sell partner products, or deliver time-sensitive offers (like same-day booking discounts).

It’s common in service booking apps, e-commerce platforms, and event apps in emerging markets where mobile internet access can be inconsistent.

The model works best when integrated into the app’s customer lifecycle, ensuring messages are relevant and not perceived as spam.

9. White labeling

White labeling means selling your app’s technology to other businesses that rebrand and market it as their own.

This can look like a fitness coaching platform resold to gyms, a booking engine adopted by travel agencies, or a SaaS CRM white-labeled for niche industries. The core product stays the same, but the branding, themes, and sometimes features are customized for each client.

The model offers scalable B2B revenue without marketing to end consumers, making it ideal for SaaS, education, fitness, and booking platforms.

10. Data licensing

Data licensing or monetization means collecting anonymized user data—such as aggregated demographics, purchasing trends, or behavioral analytics—and selling it to third parties like market research firms or advertising platforms. This can be as simple as providing usage reports or as complex as real-time data APIs.

It can be highly profitable, but strict compliance with GDPR, CCPA, and other data privacy laws is essential to maintain legal standing and user trust.

11. Donations & crowdfunding

Apps that make money through donations or crowdfunding encourage users to support the project voluntarily through in-app donation buttons or external platforms like Patreon, Kickstarter, or GoFundMe.

This could look like “support the developer” prompts in indie games, special backer-only content for a language learning app, or funding campaigns for new features in an open-source tool.

The monetization strategy works well for mission-driven, nonprofit, or creator-led apps with loyal, engaged communities.

Revenue starts with the right build

With Syndicode, your app comes ready for revenue from day one.

Contact usFree vs. premium vs. freemium model: a practical comparison

In the previous chapter, we covered the full spectrum of app monetization models. Here, we’ll zoom in on the three that dominate today’s market, each with distinct strengths, trade-offs, and ideal use cases.

The starting point in choosing a pricing model is understanding how barriers to entry impact both user acquisition and your app’s revenue potential.

- Free apps remove all friction, attract the largest audiences, and allow for multiple monetization streams. However, earnings under this model depend on how effectively you convert users after they download.

- Premium (paid) apps charge upfront, which guarantees revenue per install, but the higher entry barrier significantly reduces downloads.

- Freemium apps combine the reach of free apps with the revenue potential of paid features, offering a base version for free while upselling advanced features or content.

Here’s how they compare side-by-side:

| Factor | Free model | Premium (paid) model | Freemium model |

|---|---|---|---|

| Cost to download | $0 | $0.99–$9.99 (average) | $0 |

| User acquisition | Highest (low friction) | Lowest (high barrier) | High (low barrier, plus upsell potential) |

| Revenue source | Ads, in-app purchases, subscriptions, affiliates | One-time purchase | Paid upgrades, in-app purchases, subscriptions |

| Conversion rate | Around 10% (average) | 100% (paid upfront) | Up to 30% |

| Best for | Ad-driven, high-scale apps | Niche, high-value tools | Games, SaaS, consumer utilities |

| Key advantage | Maximum reach, multiple revenue streams | Immediate revenue per user | Balanced reach and monetization potential |

| Key risk | Monetization takes time; low ARPU if not optimized | Limited revenue ceiling; hard to scale | Requires ongoing feature development & tier management |

iOS vs. Android: key differences in in-app purchases

While both platforms support in-app purchases (IAPs), they differ in fees, policies, and user behavior, all of which can affect your app monetization strategy.

As you can see from the table below, iOS often yields higher per-user spending, while Android offers a broader user base and more payment flexibility. Therefore, many successful apps launch on both to maximize reach and revenue.

| Factor | iOS (Apple App Store) | Android (Google Play Store) |

|---|---|---|

| Platform fees | 30% commission (15% for <$1M or after 12 months of subscriptions) | Generally, up to 15% commission |

| Payment options | Apple ID one-tap checkout only | Google Play billing + some alternative payments in select regions |

| External payments | Strictly limited, mostly prohibited | Allowed for certain non-digital goods/services in some regions |

| ARPU | Higher in high-income markets | Lower overall, higher reach in emerging markets |

| Market share | ~19% globally; strong in North America, Japan, Western Europe | ~72% globally; dominant in emerging markets |

| Refund policy | Apple-managed, user-friendly | Google Play-managed, more developer visibility |

How to choose the best app monetization model?

It might be tempting to pick the most popular revenue model and run with it. But the most profitable free apps align their monetization strategies with the app’s purpose, the target audience’s behavior, and clear business goals.

Follow the five steps below to choose and refine your free app monetization strategy that will give your app the best chance of success.

And if you need support, Syndicode can help at any stage—from early business analysis to validate your concept and minimize risks, to end-to-end development services that ensure monetization is seamlessly built into your app from day one.

1. Analyze your target audience

Start with data, not assumptions. Use market reports, in-app analytics, and surveys to identify:

- Demographics: Age, location, income levels

- Behavior patterns: How often they use your app, peak user engagement times

- Spending habits: Willingness to pay for basic features, upgrades, premium content, or subscriptions

If users value premium features and a polished experience, you might lean toward subscriptions or IAPs. If they are price-sensitive but high-volume, ads or a freemium model may perform better.

2. Research competitors

Look at how free apps make money in your niche:

- Which features are free, which are gated

- Whether they use ads, subscriptions, or hybrid models

- Pricing structure and user feedback on perceived value

Use tools like Sensor Tower, App Annie, or SimilarWeb to gather revenue and user engagement data. This can reveal proven approaches in your niche and gaps you can exploit.

3. Assess your Unique Value Proposition (UVP)

Identify the specific pain points your app solves better than competitors.

- If your value is seamless UX, aggressive ads may push users away—consider paid tiers or subtle native ads;

- If your value is exclusive, high-quality content, subscriptions, or premium downloads may work best;

- If your app is transactional (e.g., marketplace), commissions and transaction fees might be the most natural choice.

4. Evaluate platform limitations and opportunities

Different platforms have different rules and advantages:

- Apple App Store has a higher average revenue per user (ARPU), especially in North America, Western Europe, and Japan. Strong brand trust increases user willingness to pay in higher-income markets. Besides, the platform is known for a strict app review process that helps maintain quality standards, which can benefit legitimate, polished apps.

The limitations, on the other hand, include higher commissions and fees compared to Google’s platform and smaller market share on the global scale. Also, the tight curation process slows down the production times and limit customization on mobile app monetization. - Google Play Store has the largest global reach and dominates the market in Asia, Africa, and South America. It has a faster app review process and more lenient guidelines, allows alternative payment methods for digital goods and easier integration with third-party tools, and supports a wide range of devices and price points, which can be beneficial for ad-driven or high-volume models.

On the other hand, Android users tend to spend less per user on apps compared to iOS. Besides, a large variety of screen sizes, OS versions, and hardware capabilities can complicate app development and QA.

Build the right app for the right platform

iOS, Android, or cross-platform: your monetization strategy only works if your app is built to match platform rules and user behavior. Syndicode’s team will help you design and develop mobile apps that are both compliant and revenue-ready.

Explore services5. Experiment and iterate

Your first choice of app monetization model doesn’t have to be permanent. Many profitable apps use hybrid monetization strategies. For example:

- Freemium + Ads

- Subscriptions + In-app purchases

- Transaction Fees + Affiliate partnerships

Besides, you can build an MVP (Minimum Viable Product) or monetization prototype to test different monetization strategies before committing. You can experiment with pricing tiers or try different ad placements, and thus identify the highest-ROI channels.

Regularly monitor metrics like ARPU, retention, churn, and LTV to adjust your approach as your audience and market evolve.

Mobile ad networks and tools that help apps make money

If you choose to monetize your app with ads, a third party ad network is what connects you (the app publisher) with advertisers willing to pay to show their ads to your users. This works the following way:

- You embed the ad network’s SDK (software development kit) into your app;

- The network matches your app’s audience with advertisers, using targeting data to deliver the most relevant ads;

- You get paid based on CPM (Cost Per Mille), CPC (Cost Per Click), or CPA/CPI (Cost Per Action or Install);

- The network bills the advertisers, deducts its share, and pays you.

Among the main benefits of using mobile ad networks is the simplicity of setup, instant monetization, and scalability. Many also use behavioral data to serve more relevant ads, increasing engagement and revenue.

Below are some of the leading mobile ad networks, each with its own strengths, payment models, and best-use cases:

1. Google AdMob

This is a leading app monetization platform and a go-to choice for apps with broad audiences and high daily active users. Backed by Google’s massive advertiser pool and precise targeting, AdMob supports banner, interstitials, native, and rewarded video ads.

The platform pays based on CPM and CPC, with global eCPMs ranging from $0.20 (banners) to $15+ (rewarded videos) in tier-1 countries.

To start working with Google AdMob, your app must be live on Google Play or the App Store, and you’ll need a Google Payments account.

2. Meta Audience Network

A strong fit for social, lifestyle, and content-driven apps whose audiences align with Meta’s advertiser base, Meta Audience Network is a popular choice for helping free apps make money. It offers excellent targeting via Facebook and Instagram data and boasts higher engagement on native ads, compared to other platforms.

The platform supports native ads, rewarded video, and interstitials. It typically pays via CPM, and eCPMs range from around $1 (banners) to over $20 (rewarded videos).

Getting started requires a verified Meta Business account, a live app, and passing Meta’s review process.

3. Unity Ads

This platform is built with gaming apps in mind, especially casual and hyper-casual titles. It offers highly relevant game ads that integrate seamlessly into gameplay loops, boosting engagement.

The platform supports rewarded videos, interstitials, and banner ads. It pays via CPI, CPA, and CPM, with rewarded video eCPMs often reaching $10–$15 in top markets.

To begin, you’ll need a Unity account and to integrate their SDK. There’s no formal review.

4. IronSource

IronSource is an app monetization platform that aggregates multiple ad networks into a single system, automatically serving the highest-paying ad available. It’s best suited for game developers seeking mediation.

IronSource supports rewarded videos, interstitials, banner ads, and offerwalls, with rewarded video eCPMs often hitting $12–$18 in top geos.

Getting started involves creating an ironSource developer account, adding your live app, integrating the SDK, and connecting your chosen ad networks.

How do popular free apps make money: case studies and takeaways

Candy Crush

Launched by King in 2012 as a casual match-three puzzle game, Candy Crush quickly became a global phenomenon thanks to its addictive gameplay loop and social integration with Facebook.

Initially, it monetized through in-app purchases, selling extra lives, boosters, and level unlocks (this model is still central to its revenue). Over time, it added ad monetization, particularly rewarded video ads for extra lives, appealing to non-paying users while still generating income.

Today, Candy Crush earns over $1 billion annually, with a balanced mix of big spenders and ad-supported casual players.

Duolingo

Founded in 2011 as a free language-learning app, Duolingo originally relied entirely on crowdsourced translations as a revenue source—a model it later abandoned.

It shifted to a freemium model: free lessons supported by ads, with a paid subscription (Duolingo Plus) offering an ad-free experience, offline access, and unlimited hearts (lives). Today, subscriptions are the dominant way to generate revenue, accounting for the majority of Duolingo’s $500+ million annual revenue, while ads still serve free users.

From this example, we can see that freemium works best when the free version is strong enough to hook app users, and the paid version removes friction rather than locks core features.

CapCut

Originally launched by ByteDance as a video editing tool to complement TikTok, CapCut is completely free with no watermark, making it incredibly appealing to creators.

Initially monetized indirectly by strengthening TikTok’s ecosystem, CapCut introduced premium features and cloud storage subscriptions in 2022, alongside subtle in-app promotions for TikTok. Now, it’s one of the top-grossing photo & video apps globally while still offering a robust free version.

Its example teaches us that building a huge user base first (even at zero revenue) can set the stage for high-value monetization later through targeted premium offerings.

Pocket began in 2007 as “Read It Later,” a bookmarking tool for saving articles and videos. It monetized primarily through sponsorships and native ads, promoting content from publishers inside the app’s recommendation feed.

Later, it introduced Pocket Premium, offering a permanent library of saved content, advanced search, and suggested tags. Now owned by Mozilla, Pocket thrives as a hybrid ad-and-subscription model, with sponsorships from high-quality publishers ensuring ads feel native.

Pocket is a great example of how high-quality, contextually relevant ads can coexist with a loyal paying audience when the core utility is strong.

In-app purchases vs. mobile website (responsive) purchases

Why build an app when you could invest in a responsive website or a PWA? After all, they look almost identical on a mobile screen, right?

Not exactly. With a standard responsive website, a user has to open a browser, type in the address (or find it in bookmarks), and wait for it to load. Those extra steps create friction, and every bit of friction can lower engagement. That’s why a free mobile app or a Progressive Web App (PWA) often performs better for acquisition and retention—and why they can be more effective ways to help apps make money over time.

A Progressive Web App is essentially a mobile-friendly web application that behaves like a native app: it can be installed on a device, works offline, and supports push notifications. The only difference is that it runs in a browser and bypasses app stores entirely.

From a monetization standpoint, the big advantage is that PWAs don’t require using Apple’s or Google’s in-app billing systems. That means you keep more of your revenue and can set pricing without platform restrictions. The trade-off? You lose the frictionless purchase flow and the built-in discoverability of app stores.

Here’s how the two approaches compare:

| Factor | In-app purchases (IAPs) | PWA purchases |

|---|---|---|

| Transaction flow | Inside the app via App Store/Google Play | In-browser via your own payment gateway |

| User experience | Seamless, one-tap with stored payment details | More friction; may require card entry/login |

| Revenue cut | Platform takes 15–30% | No store cut; only payment processor fees |

| Control over pricing | Limited by store rules | Full control over pricing, discounts, bundles |

| Data ownership | Limited — store controls billing relationship | Full customer & billing data ownership |

| Distribution | Listed in app stores; benefits from store SEO | Distributed via your channels; no app store exposure |

| Best for | Microtransactions, impulse upgrades, consumables | Subscription services, high-value purchases, avoiding store fees |

| Key advantage | Higher conversion from native convenience | Higher margins & pricing freedom |

| Key risk | Lower margins due to platform fee | Lower discoverability; potential conversion drop |

Monetize beyond the App Store

Progressive Web Apps let you keep more of your revenue and control the purchase flow. Syndicode builds fast, secure, and scalable PWAs designed for growth.

See web development servicesLatest trends in app monetization

As user expectations shift and privacy regulations tighten, mobile app developers are experimenting with monetization models that balance revenue growth with user trust and engagement. Currently, three trends stand out:

1. Privacy-friendly ads

Growing restrictions on user tracking (e.g., Apple’s App Tracking Transparency and GDPR) have forced app developers to seek advertising formats that don’t rely on personal data harvesting. Ads are now evolving to be more voluntary, relevant, and respectful of user privacy.

Two popular approaches in this respect include:

- IAA (In-App Advertising) with contextual targeting: ads are matched based on app content or user activity within the app rather than cross-app tracking;

- Rewarded ads: users opt in to watch an ad in exchange for something valuable: extra lives in a game, premium content access, or virtual currency. This format is not only privacy-safe but also drives much higher engagement rates compared to intrusive ads.

2. Microtransactions and “soft subscriptions”

As more services push for $10–$20 monthly subscriptions, app users start feeling overwhelmed. Microtransactions and soft subscriptions offer flexibility, letting users pay for exactly what they need, when they need it.

Now, instead of charging users monthly or yearly, soft subscriptions offer weekly pricing for short-term use cases (popular in fitness, dating, and lifestyle apps). This model attracts hesitant users who might resist a $10/month plan but are fine paying $1–$2 at a time.

Microtransactions stand for unlocking small, specific features without committing to a subscription or pay-as-you-go content (e.g., buying single workout videos instead of a whole fitness plan).

Over time, these smaller payments can add up to more than a traditional app subscription model.

3. Hybrid monetization models

Gone are the days of relying on a single monetization stream. Top-grossing mobile applications now combine multiple models to achieve stability by diversifying income sources.

Common combinations include:

- Freemium + Ads: A solid free tier with ads, plus a paid tier removing ads and adding features.

- Subscription + Microtransactions: A recurring plan for core content, with optional one-off purchases for premium items.

- Ads + Affiliate Marketing: Earning from in-app ads while promoting related products or services for a commission.

By mixing models, app owners can serve both free users (via ads) and high-value users (via purchases/subscriptions) without alienating either group.

Turning free apps into revenue engines: your next steps

We’ve covered everything from freemium upsells to data licensing, from privacy-friendly ads to hybrid monetization models. The takeaway is simple: there’s no one-size-fits-all approach to how apps make money. The right monetization model depends on your audience, your app’s value proposition, and the market you’re competing in.

Choosing wisely at the start and staying flexible as your user base grows can mean the difference between a free app that quietly fades away and one that becomes a long-term revenue generator.

That’s where Syndicode comes in. we’ve been helping businesses turn app ideas into profitable realities through our digital transformation services. Whether you’re building an app from scratch or optimizing an existing one, we apply the same meticulous approach that delivered results for:

- LeNewBlack – A fashion resale marketplace combining sales, marketing, and scalability in one elegant platform.

- Kinderlime – A childcare management app that became the best in its category and was ultimately acquired by an industry leader.

…And many other projects that are still waiting to be included in our featured projects list.

We don’t just build mobile applications; we engineer monetization opportunities, aligning your product’s design, features, and user experience with proven monetization strategies.

If you’re ready to transform your app idea into a sustainable business, get in touch with our sales team. Our experts will analyze your market, competitors, and audience, then map out a monetization roadmap tailored to your goals.

Your app could be the next case study in turning “free” into a thriving business model.

Read next: How much does it cost to build an app?

Frequently asked questions

-

Which generates more revenue: free apps or paid apps?

Global industry data shows paid app downloads generate about 40% of total app revenue, with median revenue per install ranging from $0.38–$0.97 on iOS and $0.14–$0.51 on Android, depending on category and region. However, while having to pay upfront can attract users with high intent and proven demand, it creates friction, resulting in lower install rates than those of free mobile apps. Some sources say that paid apps get approximately 10x fewer downloads than free apps. For a paid app to succeed, it needs strong brand recognition or clear upfront value to justify the cost. Free apps, by contrast, are easier to distribute at scale. Apps make money post-install through in-app purchases model, ads, subscriptions, or hybrid monetization strategies. With a well-planned monetization strategy, a free as have much higher chance to become profitable over time, especially in competitive markets.

-

How to tell if an app is paid or free?

Paid apps require users to pay a one-time fee to download and use the full app without additional charges. In the App Store or on Google Play, a paid app shows a price on the install button (e.g., “$1.99”), while a free app simply says “Get” or “Install”.

-

What’s the difference between a freemium app vs. a paid app?

Freemium apps provide a basic version free of charge, while paid ones offer all features upfront for a single price.

-

Which free app monetization strategies make the most money?

In-app advertising is the most widespread monetization strategy. Most apps can expect to generate an effective CPM between $0.05 and $1 from banner ads, and up to $21 from in-app video ads. Other ad formats’ eCPMs fall somewhere in between. In-app purchases (IAPs) account for nearly 50% of all mobile app revenue. For many apps, IAPs earn 20x more than subscriptions. The catch? Only about 5% of users make any in-app purchase. Subscriptions are growing rapidly. Median subscription prices are around $4.99/week, $6+/month, and $29.99/year, with yearly subscriptions boasting renewal rates above 90%. Pricing varies by category. User data monetization: for apps with valuable, anonymized user datasets, data sales can generate around $22,500–57,500 per transaction. Other models, such as affiliate marketing, white labeling, or commission-based fees, lack universal performance statistics because earnings vary widely. Revenue depends on factors like user demographics, geographic markets, app category, and the specific terms negotiated with partners.

-

How much does it cost to make a mobile app?

The cost of developing a mobile app can range from a few thousand dollars to well over $250,000, depending on complexity, features, platforms (iOS, Android, or both), and app development team location. Simple apps with basic functionality may cost $10,000–$40,000, while mid-complexity apps (e.g., marketplace, fitness tracker) often fall between $40,000–$100,000. Highly complex apps, such as large-scale social networks or enterprise tools, can exceed $200,000. Additional costs include design, backend infrastructure, maintenance, updates, and marketing. Leveraging no-code tools or MVP development can reduce upfront costs, allowing you to validate your app idea before committing to a full-scale product build.